Stocks or Real Estate? How About Both?

From an extensive list of asset classes to various investment styles, there's more than just ONE way for investors to grow their money. In fact, a popular argument amongst investors is between investing in the stock market vs investing in real estate. With the introduction of REITs in the Philippines, it is now easier than ever to invest in both stocks AND REITs. So why not just invest in both?

What is a Real Estate Investment Trust (REIT)?

A Real Estate Investment Trust (REIT) is a company principally organized for owning income-generating real estate assets. In the Philippines, REITs allow investors to buy shares of a company with a portfolio of real estate assets. These REITs trade on the Philippine Stock Exchange and are readily available for investors to buy and sell just like stocks (Note that BDO Securities investors do need to create a Name on Central Depository Account NoCD to invest in REITs).

Invest in Real Estate without the hassle of being a landlord

Let’s face it, owning real estate isn’t always an easy job. If you own rental properties, a lot of time and energy can go into managing tenants, building maintenance, real estate loans, and more. By investing in REITs, you gain exposure to income-generating real estate, but without all the hassle that comes with being a landlord.

How to earn with REITs

Dividends

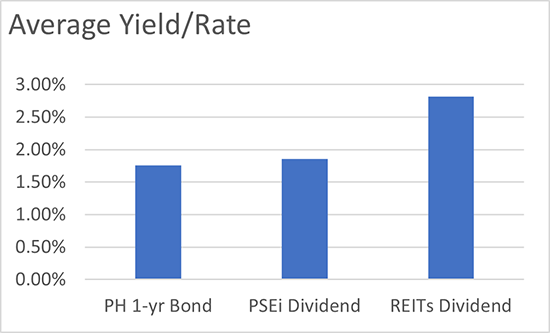

By law, REITs must distribute at least 90% of their distributable income to shareholders. Because REITs must distribute income, they can be seen as income-generating assets. In fact, as of June 3rd, 2021, you can see below that REITs trading on the Philippine Stock Exchange have an average dividend yield of 2.82%.