Sustainable Finance

BDO’s sustainable finance initiatives began in 2010, with the establishment of the Sustainable Energy Finance (SEF) Program and the Social and Environmental Management Systems (SEMS) policy, both created in partnership with the International Finance Corporation (IFC).

The SEMS evolved into what is now the BDO Sustainable Finance Framework that covers social and environmental impact assessment and risk assessment, aligned with the Bank’s Sustainability Philosophy and Strategies, as well as the UN Sustainable Development Goals.

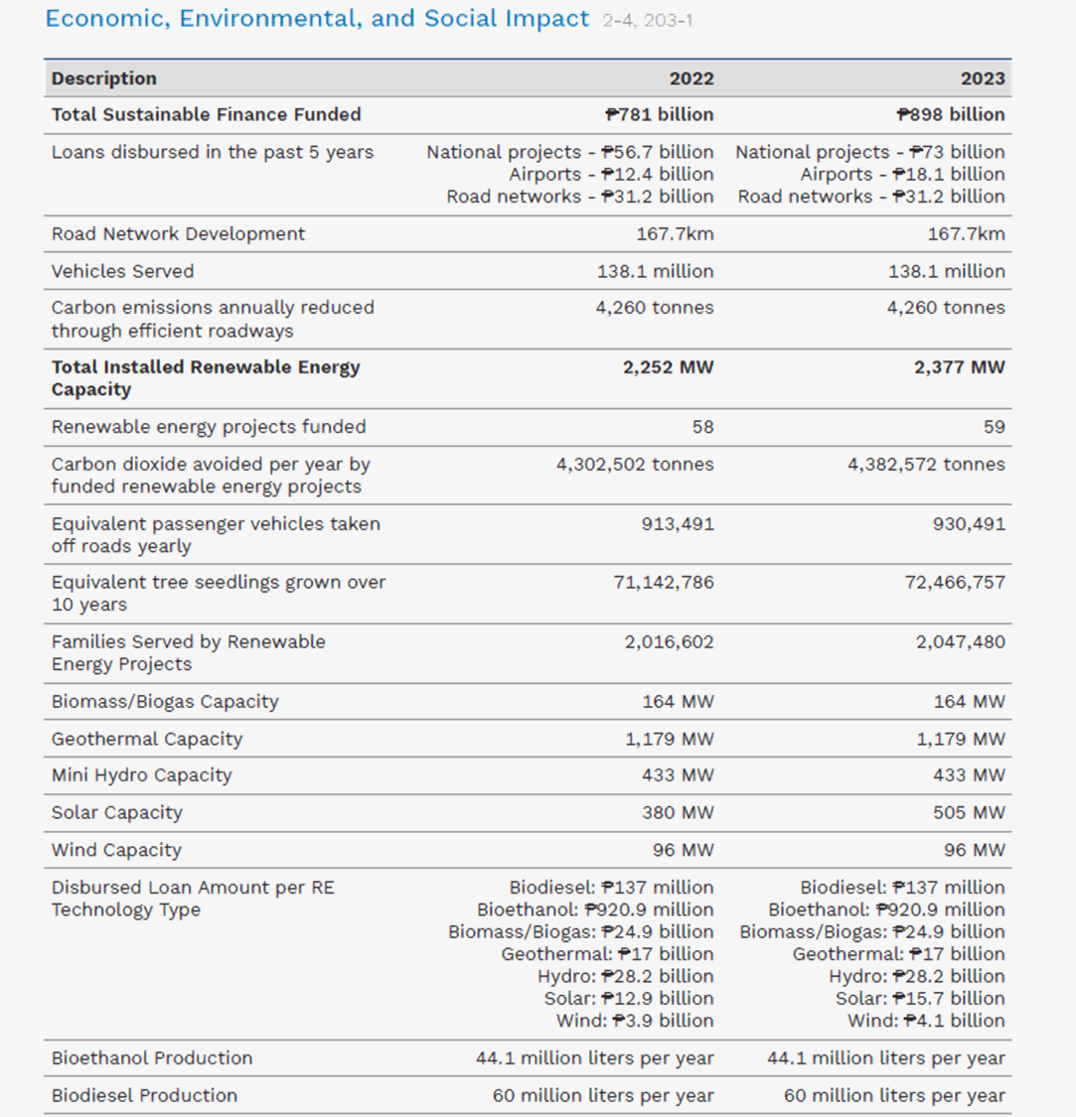

As of December 31, 2023, BDO funded P898 billion in sustainable finance, including loans to help finance 59 renewable energy projects.

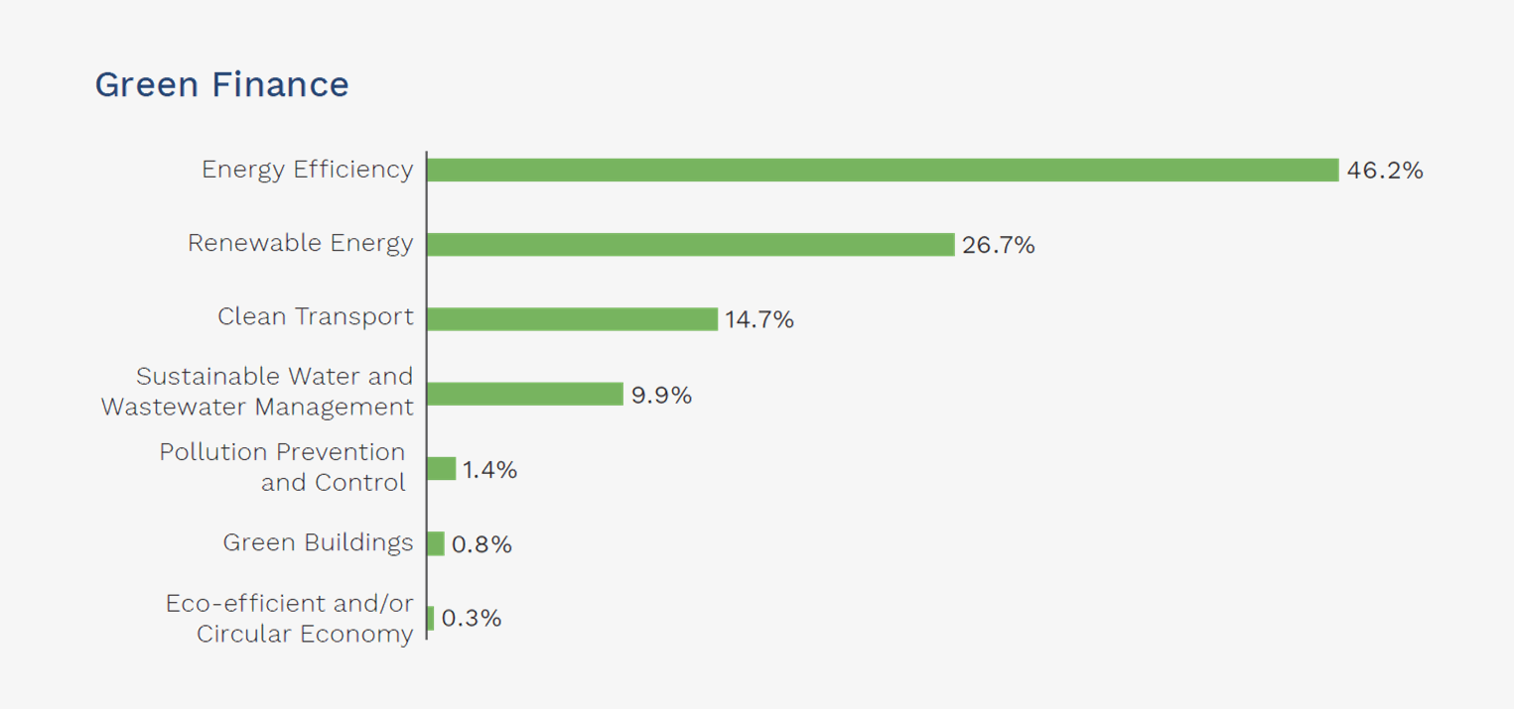

BDO continues to fulfill its commitment to finance other green initiatives including renewable energy, clean transportation, sustainable water and wastewater management, pollution prevention

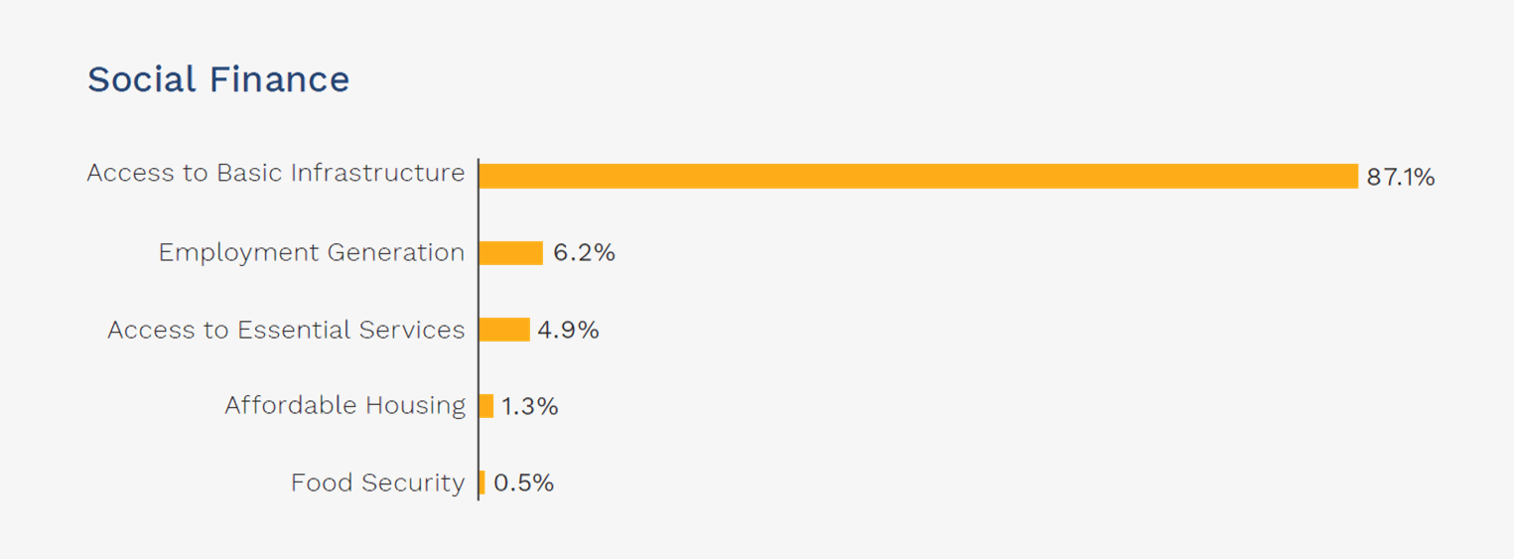

In the same year, BDO's Affordable Basic Infrastructure portfolio accounted for 87% of its Social Financing. Over P67.4 billion in loans funded social projects under Affordable Basic Infrastructure Employment Generation, Access to Essential Services, Affordable Housing, and Food Security.

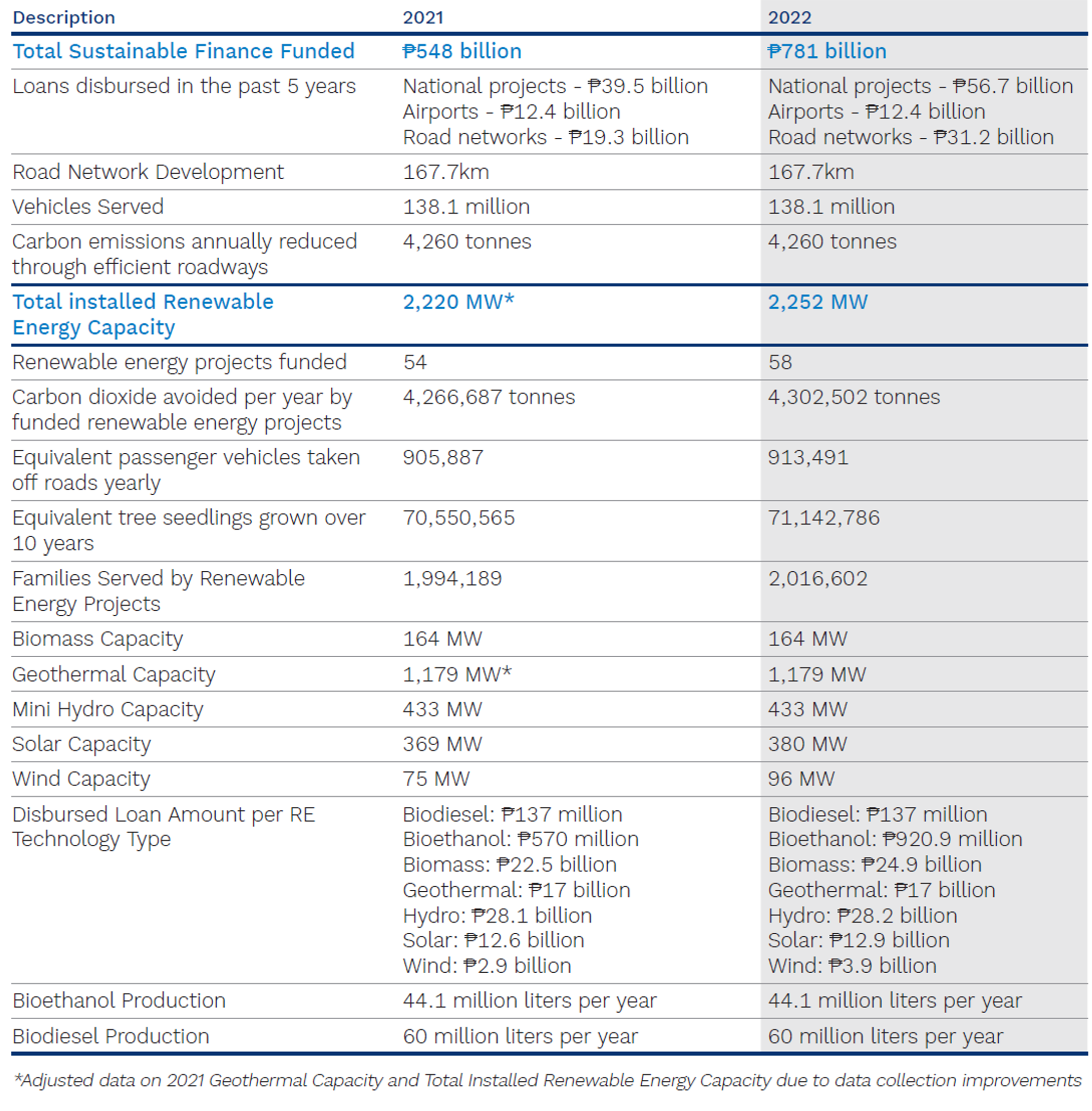

As of December 31, 2022, BDO’s total Sustainable Finance to date is at P781 billion, including 58 renewable energy projects.

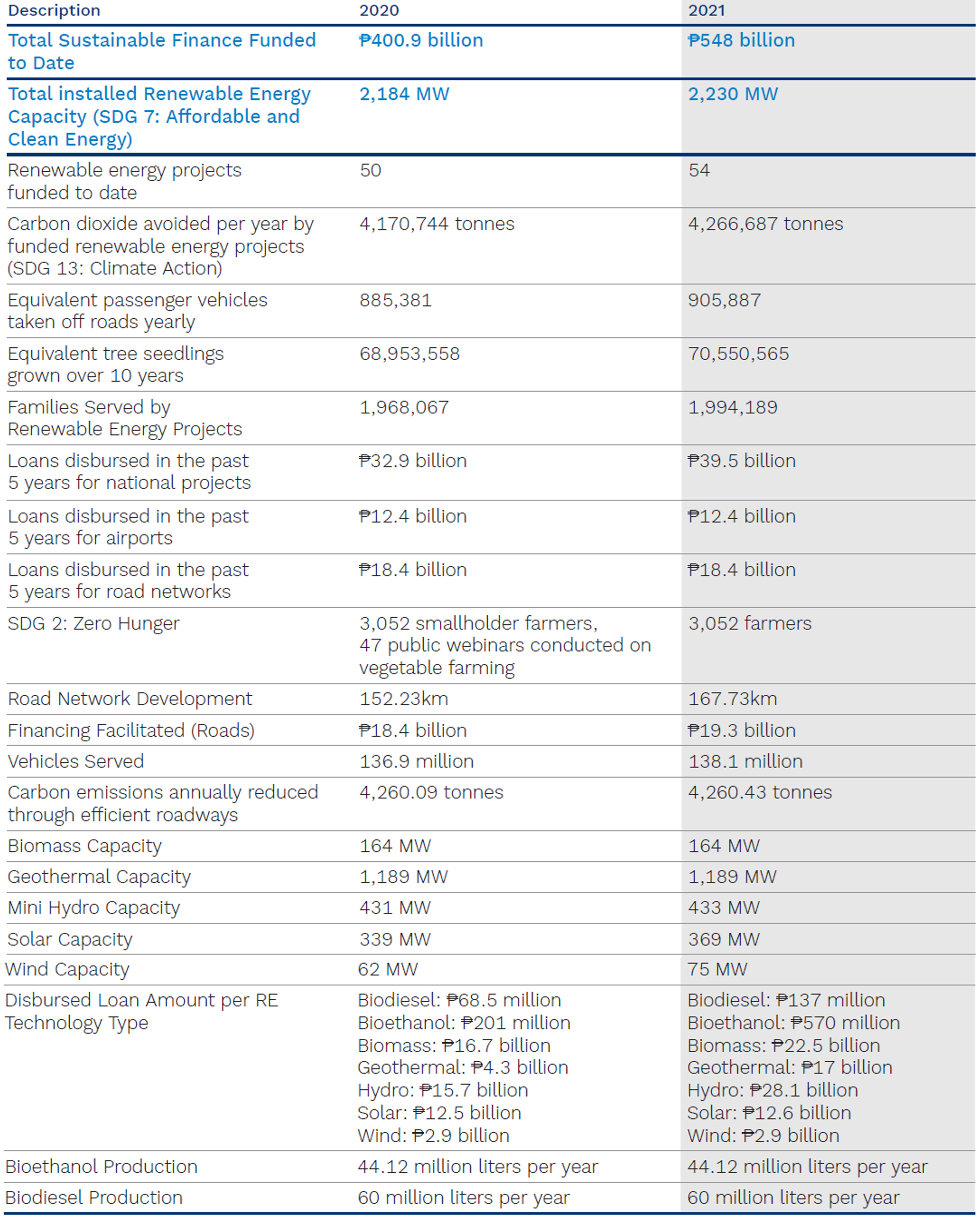

As of December 31, 2021, BDO financed 54 Sustainable Energy projects, with total Sustainable Finance funded to date at P548 billion.

Sustainable Finance Framework

The Board-approved BDO Sustainable Finance Framework is an expanded version that includes gender financing and 17 additional eligible categories under green, blue, orange and social financing that are aligned with international and local bond principles, guidelines and taxonomies, as well as the United Nations Sustainable Development Goals. The expanded SFF will allow BDO to finance more projects with high economic, environmental and social benefits through its bond issuances, contributing to ecological sustainability, ocean, health, community development and women’s empowerment.

Morningstar Sustainalytics issued an updated Second Party Opinion (SPO) stating that the BDO Sustainable Finance Framework (SFF) is credible and impactful and aligned with the Sustainability Bond Guidelines 2021, Green Bond Principles 2021, Social Bond Principles 2023, Green Loan Principles 2023, Social Loan Principles 2023, ASEAN Sustainability Bond Standards 2018, ASEAN Green Bond Standards 2018 and ASEAN Social Bond Standards 2018.

The Board-approved BDO Sustainable Finance Framework includes the eligible categories under green, blue, and social financing that are aligned with international and local bond principles, guidelines and taxonomies, as well as the United Nations Sustainable Development Goals.

Sustainability Inquiries

Kindly address sustainable finance project proposals to the BDO Sustainable Finance Desk.

BDO Sustainable Finance Desk

10/F BDO Towers Valero

8741 Paseo de Roxas Avenue

Salcedo Village

Makati City 1226

Philippines

bdo-sf@bdo.com.ph