Do you own shares of a Philippine company through a physical stock certificate?

If you do, you may be wondering how to sell the stock certificate by adding the shares to a brokerage account.

Lodgement is the process of converting a physical stock certificate to an online stock held in a brokerage account; an online stock is referred to as a scripless stock.

Whether you wish to purchase additional shares or sell the stock and invest in different companies, converting a physical stock to scripless comes with many benefits.

Before describing the process to convert a physical stock certificate, it’s important to know if your name is on the certificate or not.

Whose name is on the stock certificate?

The lodgement process to convert a physical stock to scripless can be simple if the stock is in your name. What if the stock isn’t in your name? If a stockholder has passed away and you are the heir, you must first have a stock certificate issued with your name on it. It’s important to note that BDO Securities can only lodge the stock if it’s in your name.

If there are multiple names on a stock certificate, BDO Securities cannot lodge the stock. It is possible with other brokers, but BDO Securities can’t lodge a stock certificate with more than one name.

Steps to convert a physical stock certificate with BDO Securities if your name is on the certificate

If your name is on the stock certificate and no other names are included, you should be able to convert your physical stock to scripless within seven (7) business days. You will also need to have a BDO Securities account opened. If you don’t have a BDO Securities account open, it’s very simple to open one.

______________________________________________________________________________________

Don’t have a BDO Securities account?

Click here to open a BDO Securities brokerage account in as little as 5 minutes!

______________________________________________________________________________________

The below steps can be taken to convert your physical stock certificate to an electronic (scripless) stock with BDO Securities

Lodgement steps:

- Submit the duly signed/endorsed original stock certificate/s (with client's signature on the back).

- Photocopy of two (2) valid and unexpired government issued IDs

- Originally signed BDO Securities signature card

- Signed Securities Instruction form

- Send to our office: BDO Securities Corporation, 20th Floor, South Tower, BDO Corporate Center, 7899 Makati Avenue, Makati City, 8751 Paseo De Roxas Makati City at bdosec-customercare@bdo.com.ph or call us at 8702-7878)

- Include cash for below fees when sending:

- Lodgement fee = P100.00/stock.

- Fee for each certificate sent = P20.00/certificate.

* There is an additional 12% VAT charge for non-bank affiliated transfer offices (All fees will be debited from client's BDO Securities Settlement account).

**Transfer offices (transfer agents) are the record-keepers for all stockholders of a company. There are more than 20 transfer offices in the Philippines. An example of a bank affiliated transfer office is BDO’s transfer office as it is affiliated with BDO Bank. Some transfer offices (such as San Miguel’s transfer office) are non-bank affiliated transfer office.

What to do if a stock certificate is not in your name but the name of a deceased family member

If a stockholder is deceased and you are the heir of the stock certificate, you will need to have a new stock certificate issued before BDO Securities can lodge the stock certificate.

It’s important to note that the new stock certificate can only have YOUR name on it. If multiple names are on the stock certificate, BDO Securities can’t convert the stock to a scripless stock.

Below are the steps to issue a stock in your name if you are the heir of the stock.

Steps to transfer stock into your name:

- Certified true copy of the death certificate.

- Certification from the commissioner of Bureau of Internal Revenue (BIR) attesting

to the payment (or exemption from payment as the case may be) of the estate

tax, as required by the National Internal Revenue Code.- If the shareholder is a non-Resident, certification from the proper officer of the Philippine Embassy or consulate that estate taxes due to the Philippine government under Title III, Sec. 78 of the Philippine National Internal Revenue Code have been paid. If the estate is tax exempt, certification to this effect should be secured from the consulate office.

- A two-year heir's bond issued by a duly accredited bonding company in

an amount equivalent to the total estimated market value of the shares left

by the deceased and the expected dividends thereon for the two-year period.- If no bond is issued, shares shall be transferred in the name of the heirs after a

period of two years from the date of last publication of the extra-Judicial

partition. This is pursuant to section 4 Rules 74 of the rules of court of

the Philippines.

- If no bond is issued, shares shall be transferred in the name of the heirs after a

- The transfer of a deceased stockholder's shares to his/her heir(s) may be

done in two ways:- Judicially (through court proceedings).

- Extra-judicially (out-of-court settlement).

- Additional documents for the two options:

- If settled judicially

- Whether testate (with a will) or intestate

(without a will). - Letters of administration/testamentary, issued by the probate court.

- A certified true copy of the project of partition or holographic copy of the decedent's last will and testament, indicating the division and distribution of the estate.

- Certified true copy of the court order approving disposition of the shares (part of estate) the partition or probating the decedent's will.

- Whether testate (with a will) or intestate

- If settled Extra-Judicially

- The heir/s will have to execute a Deed of Extra-Judicial Settlement (or an Affidavit of Self Adjudication, if there is only one heir). The heir/s must have the deed (or affidavit) to be registered with the Register of Deeds of the decedent's last known residence.

- The Heir/s must also have a notice of the estate's settlement published in a newspaper of general circulation (at the place where the company has its principal office) once a week for 3 consecutive weeks.

- An originally signed or certified true copy of the Deed of

Extra-Judicial Settlement (or Affidavit of Self-Adjudication), duly annotated by the Registry of Deeds. - Affidavit of publication by the publisher of the newspaper in which the Notice of Extra-Judicial Partition had been published.

- If settled judicially

- Additional documents for the two options:

Note: If the stockholder is a non-Resident*, all the documents to be submitted should be duly authenticated by the proper officer of the Philippine Embassy or Consulate.

*A non-resident is defined as a foreigner/alien not residing in the Philippines.

Once the inherited stock has been issued in your name, you can then take the initial lodgement steps listed above with BDO Securities.

Lost stock certificate

BDO Securities must receive a stock certificate with your name on it in order to process a lodgement. In order to replace a lost stock certificate, the following can be done:

Steps for lost stock certificate:

- Affidavit of Loss - duly notarized.

- Affidavit of Publication - this is issued by the newspaper company one

week after the last publication week. - Required publication of notice of loss in a newspaper of general

circulation; once a week for 3 consecutive weeks. - Surety bond – A surety bond is optional if you want to replace the stock certificate immediately. If you don’t use a surety bond, you will wait two years from the last notice of loss publication date. Surety bond premium is based on 200% of the market value of lost certificate/s.

The above requirements must be submitted to the transfer agent’s office. Standard turn-around-time is 2 weeks upon submission of complete documentary requirements. You are also required to pay for the replacement certificate.

Converting a physical stock to an electronic stock – understanding the parties involved

Prior to 1997, all stocks in the Philippines were issued physical stock certificates. At the time, it took two months to receive a physical stock certificate. In 1997, the ability to convert stock to scripless was created, and now you can hold a scripless stock in your online brokerage account with no physical stock certificate being issued.

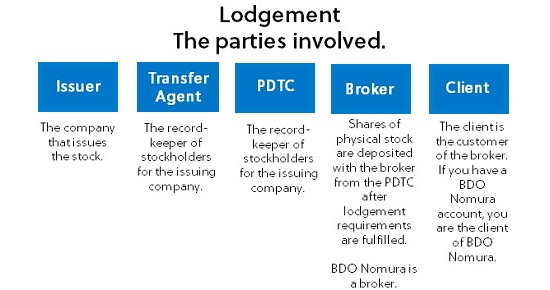

To understand the process of converting a physical stock certificate to a scripless stock, it’s important to know the parties involved.

The above graphic illustrates the different parties involved in the lodgement of physical stock certificates to scripless stocks.

Issuer – The issuer is the company that issued the stock. If you own stocks in Globe Telecom, Globe is the issuer of the stock.

Transfer Agent – The transfer agent is the record-keeper of all stocks for a company. Globe’s transfer agent will have a record of ALL physical stockholder names of the company. If you own a physical stock in a company, the transfer agent will have your name listed in their records.

PDTC – PDTC (Philippine Deposit & Trust Corporation) is the connection between the transfer agents and the brokers. Each broker has an account with PDTC; when a physical stock is converted to scripless, PDTC adds the shares to the broker’s account under “PCD Nominee Corp.”

Broker – The broker is the company you use to purchase shares on the Philippine Stock Exchange. BDO Securities is a broker – if you convert a physical stock to scripless, BDO Securities will receive the shares from PDTC, then add them to your personal brokerage account.

Client – You are the client of the broker. When you request to convert your physical stock to scripless, the shares are eventually credited to your brokerage account.

Example of the lodgement process

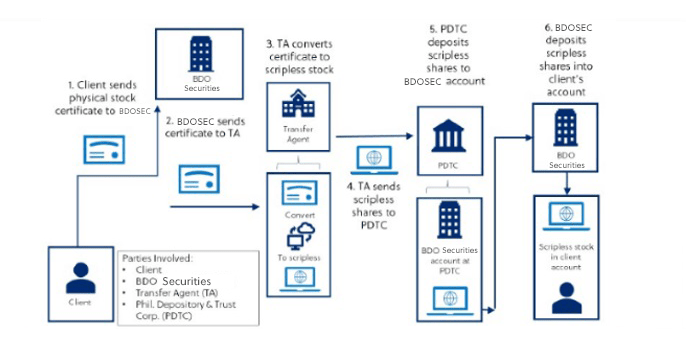

To explain the lodgment process with the different parties involved, we will use an example of a man named Bong Garcia performing a lodgement of a share of Globe Telecom stock.

First, Globe Telecom is the issuer of Bong’s physical stock certificate. Since he owns a physical stock certificate with Globe Telecom, he wants to convert it to a scripless stock so he can manage it in his online brokerage account.

'If Bong is a BDO Securitiea client, he will send the necessary requirements listed above to BDO Securities' office. Once BDO Securities receives the documents and stock certificate, the information is sent to the Transfer Agent of Globe. Remember, the transfer agent is the record-keeper of all Globe Telecom shareholders. The transfer agent of Globe will have Bong Garcia’s name in their records as a stockholder.

For example, all physical stockholders will be named in their records such as below.

Shareholders of physical stock certificates:

- Nestor Garcia

- Bong Garcia

- Jun Gomez

- PCD Nominee Corp

- Etc…

When Bong Garcia converts his stock to scripless, his name no longer appears in the books of the transfer agent. Instead, Bong Garcia’s shares show up under an account named PCD Nominee Corp.

The records will now look like this:

Shareholders of physical stock certificates

- Nestor Garcia

- June Gomez

- PCD Nominee Corp

- Etc…

This is because Globe’s transfer agent moves Bong’s shares to PDTC. PDTC receives Bong Garcia’s shares and adds them to BDO Securities' account with PDTC because BDO Securities is Bong’s stock broker.

Now that the shares appear in BDO Securities' account with PDTC. BDO Securities adds these scripless shares into Bong’s personal brokerage account so he can manage the shares as he pleases.

When it comes to converting physical stock to scripless, the process isn’t difficult if the stock is in your name. If the stock is not in your name, or if you have lost your stock certificate, there are additional steps to convert the stock to scripless, but it can be done.

There are many benefits to converting your physical stock to scripless so you can manage it in your brokerage account. You will be able to sell the stock easily and quickly, and you can take advantage of BDO Securities' immediate withdrawal to your bank account.

If you have physical stock certificate and want to lodge the stock, follow the instructions above to convert your physical stock certificate to scripless.

_______________________________________________________________________________________

Don’t have a BDO Securities account?

Click here to open a BDO Securities brokerage account in as little as 5 minutes!

_______________________________________________________________________________________