Why is this important?

What is a stock market trader?

A trader approaches the stock market from a short-term perspective. Some traders buy and sell stocks multiple times during a day. These people are referred to as day traders. Other traders hold their positions for weeks or even months. These traders are called swing traders.

Both day traders and swing traders use technical analysis to find stocks to buy and sell. These traders rely on a dictionary of indicators, from support and resistance levels to moving averages and Bollinger Bands. A stock market trader attempts to manage their risk by limiting the potential loss per trade. Many traders limit the total loss of a trade to 1% of their total capital.

For example, take someone with P500,000 of capital to trade who buys positions equally. If they take four positions and invest P125,000 per position it will add up to P500,000. If they limit each P125,000 trade to a 4% loss, this is a 1% loss of the total portfolio (P125,000 x 4% = P5,000 loss | P5,000 / P500,000 = 1%). If they decide to hold two positions for P250,000 each, they can include a loss of 2% instead of 4% (P250,000 x 2% = P5,000)

Many stock market traders must be active during the trading day; they need to keep an eye on their positions to prevent losses as well as find new opportunities.

What is a stock market investor?

Stock market investors are long-term investors also known as buy-and-hold investors. These investors buy stocks and hold them for many months and often years. Unlike the stock market trader, the long-term investor manages their stock market risk through diversification.

If a long-term investor has P 500,000 of capital to invest, they may invest all P 500,000 in stocks. Instead of limiting their losses like a trader, they purchase multiple stocks to diversify their risk. This way, if a few stocks underperform, they have many other stocks to act as shock absorbers.

Long-term investors rely more on the strength of companies’ business models and on financial reports. Long-term growth in stocks is highly correlated with a stock’s earnings; the better the earnings growth over the long-term, the more a stock will grow in value.

Long-term investing relies on fundamental analysis as opposed to traders who rely on technical analysis. Many long-term investors are less active than traders. Some long-term investors will only buy and/or sell stocks monthly, quarterly, or even annually.

What strategy is best for you?

Both trading and long-term investing can help you grow your money. If you’re interested in a more active role buying and selling stocks during the day, trading will be better suited for you. Some traders love the thrill of real-time trading and this motivates them to wake up every morning and trade the market.

You may not be looking for an active investment lifestyle. If you’re interested in a bit more of a passive investing strategy, being a long-term investor will better suit you. You can be a long-term passive investor that buys and sells stocks infrequently if that better suits your lifestyle.

You can even be a completely passive investor who invests in funds instead of individual stocks. If you don’t want to do the work to find the stocks to buy, funds will allow you to hold stock market investments without doing any work.

How to use BDO Securities as a trader or long-term investor

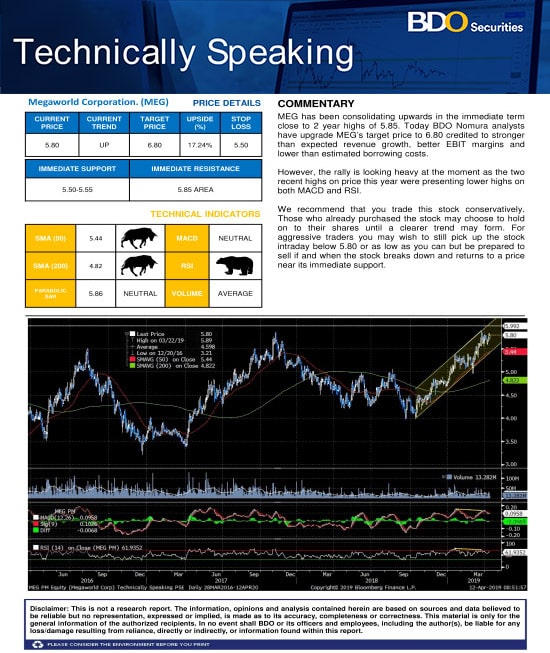

The Technically Speaking report is a report written by BDO Securities analysts and, like all BDO Securities reports, is available to any BDO Securities client free of charge. This report is a great way to keep up to date with specific stocks for trading purposes. The report includes a commentary on the stock (or index), different indicators in an easy to read structure organized by bull or bear, and support and resistance levels set by BDO Securities.

This report can help you find stocks to trade and the metrics to use when trading.

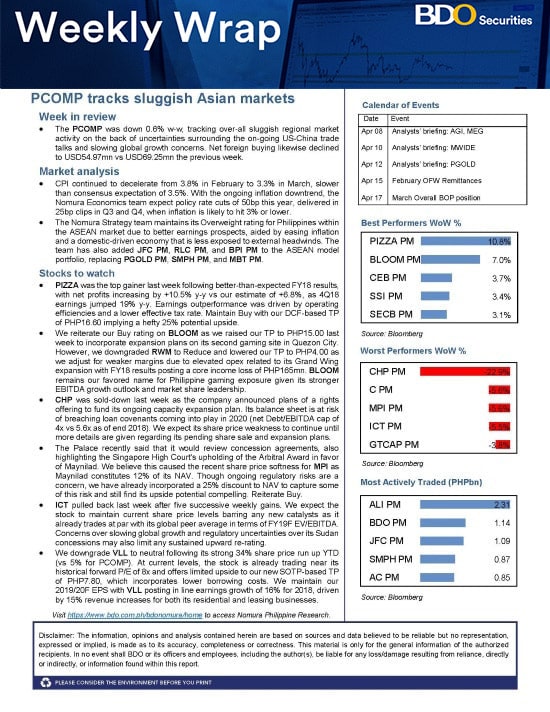

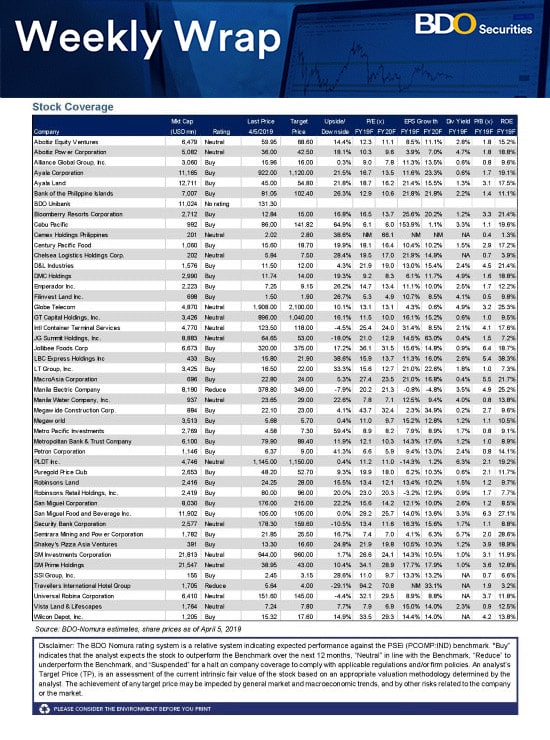

If you’re a long-term investor, BDO Securities has multiple reports to help you find stocks to buy. One of the best weekly reports available to you is the WEEKLYWRAP (see below):

Conclusion – Are you a stock market trader or investor?

It’s important to decide if you’re a stock market trader or a long-term investor. Stock market traders are more concerned with the short-term. They use technical analysis and different indicators to find ranges that stocks should be trading in. Some buy and sell within a day and are called day traders, others hold stocks for weeks or months and are called swing traders.

Long-term investors hold stocks for many months and often years. These traders are more concerned with fundamental analysis, such as company earnings and financial statement information. Long-term investors can be less active than traders since they hold stocks for long periods of time.

No matter which strategy you use, BDO Securities provides useful reports for both traders and long-term investors. Traders can use the Technically Speaking report to help them find companies to trade, and long-term investors can use the WEEKLYWRAP and other reports to find companies with buy ratings.

Whichever style you choose, it’s important to know whether you’re a trader or long-term investor so you may use the proper methods to manage risk and find companies to buy and sell.

_____________________________________________________________________________________

Don’t have a BDO Securities account?

Click here to open a BDO Securities brokerage account in as little as 5 minutes!

_____________________________________________________________________________________