BDO Securities uses different valuation methods depending on the company being analyzed. One company may be valued using the DCF method, another may be valued using EV/EBITDA, and so on. The valuation method used by the BDO Securities analysts for a particular company can range depending on the company’s business model, the structure of the company, industry of the company, etc.

If different valuation methods are used for different companies, what method should be used to value a company with different companies housed under one large conglomerate? For example, if a conglomerate houses a bank and a food processing business, what method should be used to value that conglomerate? The answer is to use the SOTP method of valuation.

Sum-of-the-parts (SOTP) valuation

The SOTP valuation method involves valuing the different segments of a business and combining those to create a target price of the company stock. The formula for SOTP is as follows:

SOTP

= value of 1st business segment

+ value of 2nd business segment

+ … value of nth business segment

= gross asset value

- parent debt + parent cash (or parent net debt)

= net asset value (NAV)

x (1 – conglomerate discount %)

= target price

Let’s use a hypothetical example similar to the above and calculate the SOTP for a conglomerate that owns a banking business and a food processing business.

Richie Rich Corp.

Richie Rich Corp. is a conglomerate that owns Yap Bank and Tsai Foods.

In order to calculate the SOTP for Richie Rich Corp., we will first need to value both Yap Bank and Tsai Foods. Let’s start with Yap Bank.

Yap Bank

To value Yap Bank we will use the dividend discount model (DDM). As you may recall from our DDM article, we calculate the value of Yap Bank given a cost of equity of 14% and dividend growth rate of 9.75%:

Target price of stock = forecasted dividend / (cost of equity – growth rate of dividend)

Target price of stock = P1.00 / (0.14 – 0.0975)

Target price of stock = P23.53

*See the dividend discount model article for more details on how to get these numbers.

Once we have the value of the stock price for Yap Bank, we can multiply it by the shares outstanding to get the value of the bank in Pesos. We will assume Yap Bank has 1 billion shares outstanding:

Value of Yap Bank = shares outstanding x target price of stock

Value of Yap Bank = 1,000,000,000 x P23.53

Value of Yap Bank = P23,530,000,000

Now that we have the value of Yap Bank, we can calculate the value of Tsai Foods.

Tsai Foods

To value Tsai Foods, we will use the discounted cash flow (DCF) method. To calculate the DCF we will assume a weighted average cost of capital (WACC) of 9% and cash flow growth of 5%. We will first use 5 years of cashflows and then a terminal value to calculate the DCF of Tsai Foods.

5 years of discounted cashflows

Year 1 Cashflow: (P100,000,000 x (1+5%)) / (1+9%) = P96,330,275

Year 2 Cashflow: (P100,000,000 x (1+5%)^2) / (1+9%)^2 = P92,795,219

Year 3 Cashflow: (P100,000,000 x (1+5%)^3) / (1+9%)^3 = P89,389,890

Year 4 Cashflow: (P100,000,000 x (1+5%)^4) / (1+9%)^4 = P86,109,527

Year 5 Cashflow: (P100,000,000 x (1+5%)^5) / (1+9%)^5 = P82,949,545

Total Cashflows = P447,574,456

Now that we know Tsai Foods will generate P447,574,456 in discounted cashflows over the next five years, we can calculate the terminal value assuming a perpetual growth rate of 4% and WACC of 9%:

Terminal value = final year projected cash flow * (1+ perpetual growth rate) / (WACC – perpetual growth rate)

Terminal value = P82,949,545 * ((1+ 4%) / (9% - 4%))

Terminal value = P82,949,545 * 20.8

Terminal value = P1,725,350,536

Now that we have the terminal value we can calculate the value of Tsai Foods using the DCF.

DCF = 5 years discounted cashflows + terminal value

DCF = P447,574,456 + P1,725,350,536

DCF = P2,172,924,992

If there was net debt for Tsai Foods, we would now subtract it. However, for simplicity, we will assume the company has no net debt.

Now that we’ve calculated the value of both Yap Bank and Tsai Corp, we can calculate the net asset value of Richie Rich Corp.

*See the DCF article for more details on how to get these numbers.

Richie Rich Corp Target Price

Before we calculate the target price of Richie Rich Corp, we can look up parent debt and cash from the parent (or holding company) balance sheet. Below are the numbers for Richie Rich Corp.

Assumed parent debt = P250,000,000

Assumed parent cash = P50,000,000

We now have everything we need to calculate the net asset value (NAV) of Richie Rich Corp. using the SOTP:

SOTP

= value of 1st business segment

+ value of 2nd business segment

+ … value of nth business segment

= gross asset value

- parent debt + parent cash (or parent net debt)

= net asset value (NAV)

Below we can compute given our values.

SOTP

= P23,530,000,000

+ P2,172,924,992

= P25,702,924,992

- P250,000,000 + P50,000,000

= P25,502,924,992

According to the SOTP method of valuation, Richie Rich Corp. has a net asset value (NAV) or intrinsic value worth P25,502,924,992. To calculate the NAV per share all we need to do is divide the total value of the company by the shares outstanding (assuming 1 billion shares outstanding).

NAV per share = value of the company / shares outstanding

NAV per share = P25,502,924,992/ 1,000,000,000

NAV per share = P25.50

According to the SOTP method of valuation, Richie Rich Corp. is worth P25.50/share. You can now look at Richie Rich Corp. and see if it’s trading at more or less than P25.50. If it is trading below/above the NAV, the stock may be undervalued/overvalued and is said to be trading at a discount/premium to NAV. If the Richie Rich stock is selling for P12, the stock is said to be trading at a 53% discount to NAV and may be undervalued (buying opportunity).

Note that conglomerates own multiple businesses in various industries. It’s common to see share prices of conglomerates trade below their NAVs. This phenomenon is known as the conglomerate discount. This represents the valuation discount applied by the stock market to the share price of a conglomerate due to perceived inefficiencies from having multiple unrelated businesses. The value of the conglomerate discount varies depending on investors’ perception of the company.

BDO Securities analysts typically apply a conglomerate discount to their NAV estimate to factor this in and arrive at their target price.

Target price = NAV per share x (1 - conglomerate discount)

Going back to our example for Richie Rich Corp., assuming a conglomerate discount of 40%,

Target price = NAV x (1 – conglomerate discount %)

Target Price = P25.50x (1 – 40%)

Target Price = P15.30

We now know the SOTP target price for Richie Rich, Corp. is P15.30. If the stock is selling for P12, there is an upside potential of 28%. Depending on your financial goals and risk appetite, this could be a healthy upside potential.

SOTP using Metro Pacific Investments (MPI)

Let’s look at a real-world example of how the BDO Securities analysts use a SOTP method for Metro Pacific Investments (MPI).

MPI includes different companies, ranging from power distribution and utilities, to hospitals and toll roads. Because there are multiple different companies, BDO Securities analysts prefer a SOTP method for valuation.

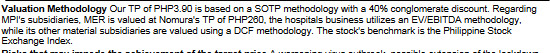

Below you can see the MPI valuation methodology from the May 07, 2020 coverage report.

The target price for MPI is based on SOTP which combines the values of Meralco (SOTP), its hospital business (EV/EBITDA), and tollroads and water businesses (DCF). A conglomerate discount is also factored in after valuing the different companies.

The BDO Securities analysts used the SOTP to derive the below May 07, 2020 rating and target price.

Many large conglomerates valued by BDO Securities analysts utilize an SOTP method of valuation because they include different companies that are oftentimes in different industries.

Another article to help you invest and find stocks with BDO Securities:

Dividend Investing with BDO Securities

Disclaimer: This is not a research report. The information, opinions and analysis contained herein are based on sources and data believed to be reliable but no representation, expressed or implied, is made as to its accuracy, completeness or correctness. This material is only for the general information of the authorized recipients. In no event shall BDO Securities or its officers and employees, including the author(s), be liable for any loss/damage resulting from reliance, directly or indirectly, or information found within this report.