As a millennial, the way you approach stock market investing will differ in some ways from the older generations nearing or in retirement. Since millennials are still quite young, those in the millennial generation are nearly all in the accumulation phase of investing. There are key differences between millennials in the accumulation phase of investing and the older generations in the distribution phase. Below are some key points for Filipino millennials looking to invest in stocks in the Philippines.

Investment risk and millennials

As previously mentioned, nearly all millennial investors are in the accumulation phase of investing. What’s the accumulation phase? It’s the continued saving and investing of money to grow for many years into the future.

The older generations are in (or near) the distribution phase of investing. This is the point where the money they have accumulated over many years is distributed for living expenses in retirement. A millennial in the accumulation phase can take more risk than someone in the distribution phase. If you’re 28 years old and retire when you’re 65, you have 37 years until you need the money you are currently investing.

Those in the distribution phase of retirement will need to withdraw money annually for their expenses. For this reason, at least a portion of their investments must stay in a lower risk asset classes, such as bonds. Millennials don’t necessarily need safe bonds because they won’t need to use the money immediately. This gives millennials key advantages when it comes to risk – from the ability to try strategies such as trading, to holding a portfolio one hundred percent invested in stocks with no bonds.

Millennial investment style

Time is on the side of the millennial when it comes to investing. If you invest P50,000 today, you may not touch that money for many years. The lack of necessity leads to an ability to test different investment strategies. The ability to learn how to trade stocks during short term periods of time is one of the millennial investment advantages.

Stock trading

Stock market trading is a short-term investment style wherein individual stocks are bought and sold quickly to make immediate profits. Stock trading can be lucrative for investors, but there is a learning curve. It’s difficult for the older generation to learn stock trading while they are in the distribution phase of retirement since they will need money in the near-term.

Millennials, on the other hand, have time on their side. If you learn how to trade stocks as a millennial, you can afford to take some losses in the beginning as you learn how to master stock market trading. For this reason, millennials have the advantage when it comes to learning how to trade stocks.

Portfolio diversification

If you’re a millennial investing with a long-term investment style, you have another advantage over the older generation – portfolio risk. A portfolio is an assortment of different stocks, bonds, and other potential investments such as commodities. Since retirees can’t afford much volatility in their investment portfolios, they often hold a large chunk of their money in less risky investments such as bonds. Since bonds have less risk, they also have a lower expected growth potential than stocks over the long-term.

As a millennial you have time on your side and volatility isn’t as important. If your stock portfolio loses value this year, you have many years for your stocks to recoup that loss and grow in value. Holding a properly diversified portfolio of stocks without bonds should grow more than a portfolio of stocks with bonds over the long-term. Millennials have an advantage when it comes to both trading and long-term investing. The next question is…how can millennials use BDO Securities to invest?

How to use BDO Securities to invest as a Millennial

When you begin investing in the Philippine Stock Exchange as a millennial, you will first want to decide your investment strategy. If you decide to buy individual stocks, BDO Securities is the perfect broker for you. However, deciding whether to buy stocks isn’t the only decision you need to make – you also need to decide if you will trade stocks or create a long-term buy and hold portfolio of stocks. The investment style you choose will lead you to different strategies. BDO Securities makes it easy to both trade stocks and buy stocks for long-term investment.

Trading stocks with BDO Securities

If you decide to trade stocks, you will first need to find stocks to buy. This is always a difficult part of investing, but BDO Securities does offer a report that may help. The Technically Speaking report highlights one stock per week with commentary on the prices of the stock from a trading perspective. Using the report can help you find ideas for a stock to trade each week.

Another helpful report is the Morning Brief. This report helps you stay on top of the daily market to navigate the trends. Once you find a few stocks to trade, the indicators you use and the risk strategies you implement will be important. When it comes to risk, you may want to manage the potential loss per trade. Some traders limit their loss to 1% of their overall portfolio.

For example, if you have P500,000 to trade and buy five positions at P100,000 per position, this will add up to a portfolio of P500,000. If you limit each P100,000 trade to a 5% loss, this is 1% of your total portfolio (P500,000 x 5% = P5,000 | P5,000 / P500,000 = 1%)

Another example to manage your risk is to pick stocks with a higher upside than your stop-loss. For example, if a company has an upside potential of 3% and you set your stop loss at a 1% loss, that is a healthy risk to reward ratio.

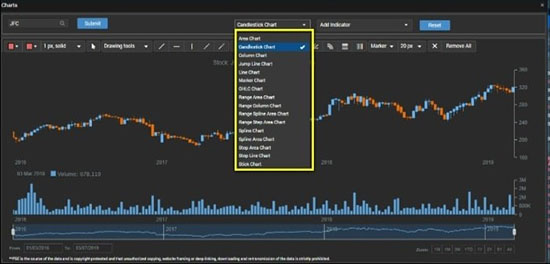

The indicators you use to trade stocks are also important. There are many indicators used by stock market traders – BDO Securities offers many of these indicators by accessing the charting window (see below):

Buy and hold investing with BDO Securities

If you decide to implement a long-term buy and hold strategy in lieu of a trading strategy, you will need to build a portfolio of stocks. It’s important to build a diversified portfolio of company stocks to help you manage stock market risk and achieve a healthy rate of growth.

There’s no exact number regarding how many stocks are needed to create a diversified portfolio. However, a portfolio with between ten to thirty stocks may work best. After deciding the number of stocks to purchase, the next hurdle is finding stocks. For buy-and-hold investors, BDO Securities offers several reports to help you find quality stock investments.

The first report is called the Weekly Wrap. This report has a lot of value for investors since it includes BDO Securities’ projected upside and downside potential of over forty stocks. Stocks with a healthy upside found in the Weekly Wrap may be potential buys. Some of these stocks can be added to create your diversified portfolio. Other valuable reports from BDO Securities include the Stock of the Week and Coverage Reports. Each of these reports provide valuable information that can help you with your search for stocks to invest in.

Conclusion – Stock market investing for millennials in the Philippines

As a millennial, you’re likely in the accumulation phase of investing. Unlike older generations, millennials in the accumulation phase have more room to take risk and try new investment strategies. If you’re interested in learning how to trade stocks, you have the time to learn trading tactics and can even risk small losses as you learn.

If you’re interested in buy-and-hold investing, you can take more risk by creating a portfolio of one hundred percent stocks with no bonds. Whether you decide to trade stocks or create a long-term investment portfolio, BDO Securities is the perfect online broker to help.

If you trade, you can use the BDO Securities Technically Speaking report to help find stocks to trade each week and the Morning Brief and stay on top of the daily market. As a long-term investor, you can use the Weekly Wrap, Stock of the Week, and Coverage Reports to find stocks to add to your portfolio. Investing in the Philippine Stock Market has never been so easy.

If you’re not yet a BDO Securities customer, click the link below to learn how to open an account.

Don’t have a BDO Securities account?

Click here to open a BDO Securities brokerage account in as little as 5 minutes!