What attracts you to the idea of trading stocks? Is it the potential gains you can earn? Or, is it the challenge of technical analysis that comes with trading? Whatever the reason, there’s a good chance you’re focused on learning and mastering the art of technical analysis and pattern recognition. This is the buy side of trading and it involves the methodology you use to find trading opportunities. The buy side is the appealing side of trading. Using your technical skills and pattern recognition to find the perfect stock trading at the perfect price with the perfect potential to pop.

But, what if we told you the tantalizing buy side of trading is actually NOT the most important part of trading?

You may not like to hear it, but the fact is stocks don’t always act how you think they will. No matter how amazing the chart looks, there’s always a chance the price of the stock declines and squeezes you out; even if it leads to a pop in the stock price after you sell.

So, if the buy side isn’t the most important aspect of trading, what is?

The answer: it’s the money management and risk management side of trading.

What is risk management and money management?

Risk management and money management are perhaps the only factors you have control over when trading. Afterall, you don’t have control over the future price movement of a stock. What you can control is the risk you take. Some different ways you can manage risk is through your allocation maximum, risk per trade, risk/reward ratio, etc.

Managing risk should be planned ahead of time by creating a personalized trade plan.

Create a trade plan

Every trader is different. The way you trade will be dependent on your risk tolerance, your personality, the amount you have available to invest, etc. Because every trader is different, it’s important to create a trade plan that you will stick to. A trade plan should include everything from your portfolio allocation maximum, and risk per trade, to your preferred risk/reward ratio.

Your trade plan should include two categories of rules. The first category relates to your total portfolio balance. The second category applies to specific trades.

Category 1 – Portfolio Rules

Portfolio rules relate to the overall balance of your portfolio (not specific trades). For example, if you have P10,000,000 total in your portfolio, these rules relate to that money.

Portfolio Rule 1: Portfolio allocation maximum

The amount of your portfolio you allocate to any one trade is a personal decision. Some investors will only allocate 5% - 10% of their portfolio into one trade, while other investors may allocate 20% or even more to a trade. One factor to consider is how many positions you want to hold at any one point in time and how much you want to keep in cash on the sidelines.

For example, if you are someone who may want 5 equal sized positions open at the same time with no cash, you wouldn’t want to allocate more than 20% of your portfolio to any one trade. You can see why below:

P500,000 portfolio

Position 1 – P100,000 = 20% of portfolio

Position 2 – P100,000 = 20% of portfolio

Position 3 – P100,000 = 20% of portfolio

Position 4 – P100,000 = 20% of portfolio

Position 5 – P100,000 = 20% of portfolio

As you can see, having five equal positions open at the same time would require a maximum of 20% of your portfolio in each position. Your portfolio allocation maximum may depend on your risk tolerance. Some hypothetical risk tolerance examples can be seen below:

Portfolio Allocation Maximum

Conservative = 5%

Moderate = 15%

Aggressive = 25%

Taking these risk tolerances, you could expect to invest the following with a P500,000 portfolio:

Conservative = 12.5%

- Position 1 = P62,500

- Position 2 = P62,500

- Position 3 = P62,500

- Position 4 = P62,500

- Position 5 = P62,500

- Position 6 = P62,500

- Position 7 = P62,500

- Position 8 = P62,500

- Position 9 = P62,500

- Position 10 = P62,500

Moderate = 20%

- Position 1 = P100,000

- Position 2 = P100,000

- Position 3 = P100,000

- Position 4 = P100,000

- Position 5 = P100,000

- Position 6 = P100,000

- Position 7 = P100,000

- Position 8 = P100,000

- Position 9 = P100,000

- Position 10 = P100,000

Aggressive = 25%

- Position 1 = P125,000

- Position 2 = P125,000

- Position 3 = P125,000

- Position 4 = P125,000

Now that you understand the importance of choosing a portfolio allocation maximum, you should next focus on understanding stop losses and position sizing.

Stop loss

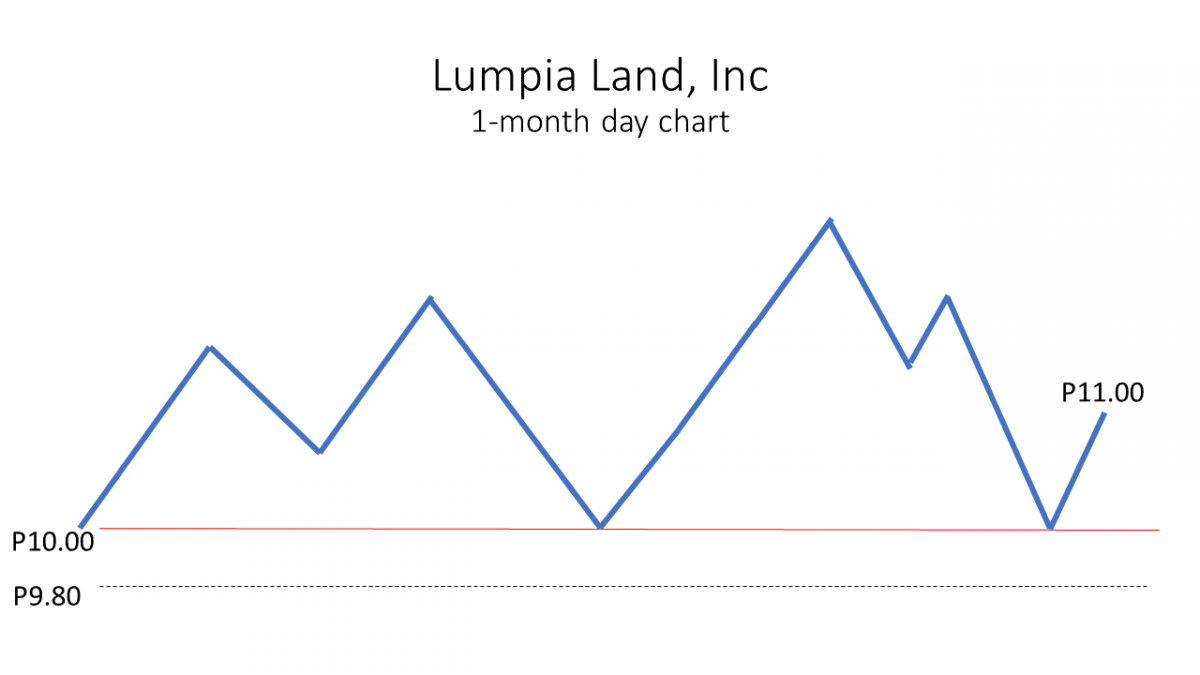

A stop loss is the predetermined price you set to sell a stock. By choosing a stop loss you are choosing an exit price. Stop losses can be used to both limit your downside risk and help you calculate your position size. To better understand stop losses, take the following chart.

The above stock, Lumpia Land, Inc, is currently selling for P11.00. The red line shows a support line for the stock; the stock hasn’t broken the line and there is a potential for it to bounce at the P10.00 level. However, there is also a possibility the stock will break the P10.00 support and continue lower. If this happens, you should have decided a stop loss to limit your loss potential. The above dashed line shows the P9.80 stop loss. So, if you buy at P11.00 and the stock falls to P9.80, you will sell the stock and take your losses.

Stop losses are extremely important tools for traders and using them can help you manage risk.

* There are no automatic stop losses with BDO Securities. You will need to manually track your positions and sell them if they reach your predetermined stop loss.

Portfolio Rule 2: Position sizing

You may have heard of the 1% rule, the 2% rule, the 5% rule, etc. Each of these rules are preferences traders have regarding their risk per trade. For example, if you follow the 1% rule, you would only risk 1% of your portfolio allocation maximum. If you have a P500,000 portfolio and a 20% portfolio allocation maximum (P100,000), you could calculate your risk per trade for Lumpia Land, Inc:

Position Sizing:

- Portfolio balance = P500,000

- 20% Portfolio allocation max = P100,000

- 1% maximum risk per trade = P5,000

The position sizing percentage will be determined by your risk tolerance. Below are some hypothetical examples of position sizing risk tolerances:

Position sizing:

Portfolio balance = P500,000

20% allocation max

- Aggressive Risk (3% per trade) = P15,000

- Moderate Risk (1% per trade) = P5,000

- Conservative Risk (0.5% per trade) = P2,500

Going back to Lumpia Land, Inc, it’s selling for P11.00 and we’ve decided to add a stop loss at P9.80. In order to calculate our position sizing (the number of shares to purchase) we can do the following using a 1% maximum risk per trade:

Position sizing = (portfolio balance x maximum risk per trade) / (stock price – stop loss)

Position sizing = (P500,000 x 1%) / (P11 – P9.80)

Position sizing = (P5,000) / (P1.2)

Position sizing = 4,166 shares

Using our formula to find the position size, we’ve determined that we’re willing to risk buying 4,166 shares of Lumpia Land, Inc. This will total P45,826 (4,166 shares x P11.00 per share). If the price of Lumpia Land, Ince falls to P9.80 per share, you will be down P5,000 which is 1% of your allocation maximum (P5,000 / P500,000). We would also check to make sure the position sizing is in range. Using a 20% position size we can see that the P45,826 is not more than the 20% predetermined position size (P500,000 x 20% = P100,000). So the trade meets all the criteria.

Category 2 – Individual Trade Rules

The next category of rules involves specific trades. Unlike the portfolio allocation maximum and position sizing, the individual trade rules don’t factor in the overall portfolio. Each of these rules are dependent on the specific trade.

Individual Trade Rule 1: Risk/reward ratio

Another important part of trading is the risk reward ratio. This is represented as a ratio and it shows the risk (loss) you are willing to take in proportion to the potential reward (profit).

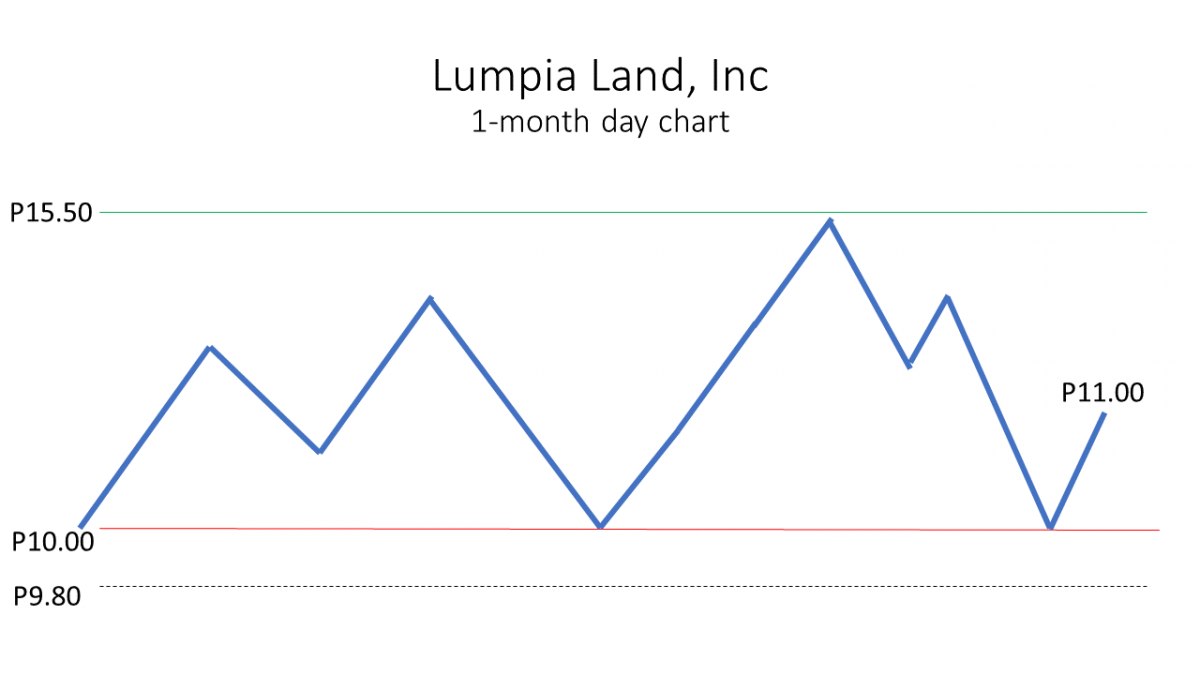

For our Lumpia Land, Inc. example, we can assume our same predetermined stop loss of P9.80.

Looking at the chart we can see there is a potential resistance at P15.50. We may decide to take profits if Lumpia Land, Inc. reaches P15.00. The risk to reward ratio can be calculated using the following:

Risk to reward ratio

- Stock price = P11.00

- Take profits = P15.00

- Stop loss = P9.80

- Risk = P1.20

- Reward = P4.00

- Risk to reward ratio = 1.2 : 4

Having a proper risk reward ratio is an important part of trading and risk management. If you are willing to accept large risks for small returns, you won’t be very profitable.

While the risk reward ratio is important, it also coincides with the win/loss ratio. Having a proper risk/reward AND win/loss ratio are important for each individual trade.

Individual Trade Rule 2: Win/loss Ratio

The win/loss ratio can be explained like a baseball batting average; the number of hits versus strikeouts. A hit would be considered a profitable trade and a strikeout would be considered an unprofitable trade. The proportion of profitable trades (wins) versus unprofitable trades (losses) equal the win/loss ratio.

The below chart shows the relationship between the portfolio allocation, win/loss ratio (batting average) and a proper risk/reward ratio.

Assumptions:

- P500,000 portfolio

- Average trade size is 20% portfolio allocation (P100,000)

- Average of ten (10) trades a year

- Average profit is +15%; loss is -5% per trade

We highly suggest watching our video regarding risk management here: Risk Management Video