When retirement is knocking on your door a new lifestyle is just around the corner. The days of traveling to work every morning can finally be exchanged for time spent with your family and friends.

As you near retirement, the assets you have gathered and the money you have saved are extremely important. After all, this is your nest egg and it will need to provide you with money for the rest of your life.

When some investors near retirement, they fail to make proper adjustments to their investments. The last thing an investor wants as they near retirement is a sudden decline in their nest egg. When it comes to retirement, your mix of investments is important, as well as the style of investing you practice.

Below are some ways BDO Securities and BDO Unibank can help.

Asset allocation

If you’re a year or two away from retirement, you should invest differently than you did when you were fifteen years away from retirement. One important consideration is your asset allocation.

Asset allocation is the ratio of money you have spread between different assets. For example, many investors keep most of their money in real estate and stocks. Both real estate and stocks are considered asset classes. While it’s ideal for many investors to have most of their investments in real estate and stocks, it may be a bit too aggressive for someone nearing retirement. Bonds may be a consideration to add to your investment mix.

There is no one answer for the percentage of a portfolio that should be in stocks vs. bonds. However, when nearing retirement, many financial professionals would recommend a mix of at least fifty percent bonds and fifty percent stocks. While this completely depends on your age, the amount of money you have saved, and your risk tolerance, the fifty percent stocks and fifty percent bonds model is just a general guide.

If you have just enough money for retirement and can’t risk any decline in value, you may want more bonds in your portfolio. If you have plenty of money for retirement, more stocks in your investment allocation may be suitable.

Dividend investing

Many investors nearing retirement use a dividend income investment strategy. Investing in dividend stocks helps generate income that can be used in retirement. This income can be spent on expenses when in retirement, or it can be reinvested into the stock market (or bond market) to increase your investments.

By investing in dividend stocks as you near retirement, you can start building an income stream of dividend income. Once you reach retirement, you will have built a portfolio with dividend-paying stocks to help supplement your finances.

Remember, if you use an asset allocation with a percentage of stocks and a percentage of bonds, you will only invest the percentage allocated towards stocks into dividend stocks. The other percentage will be held in bonds.

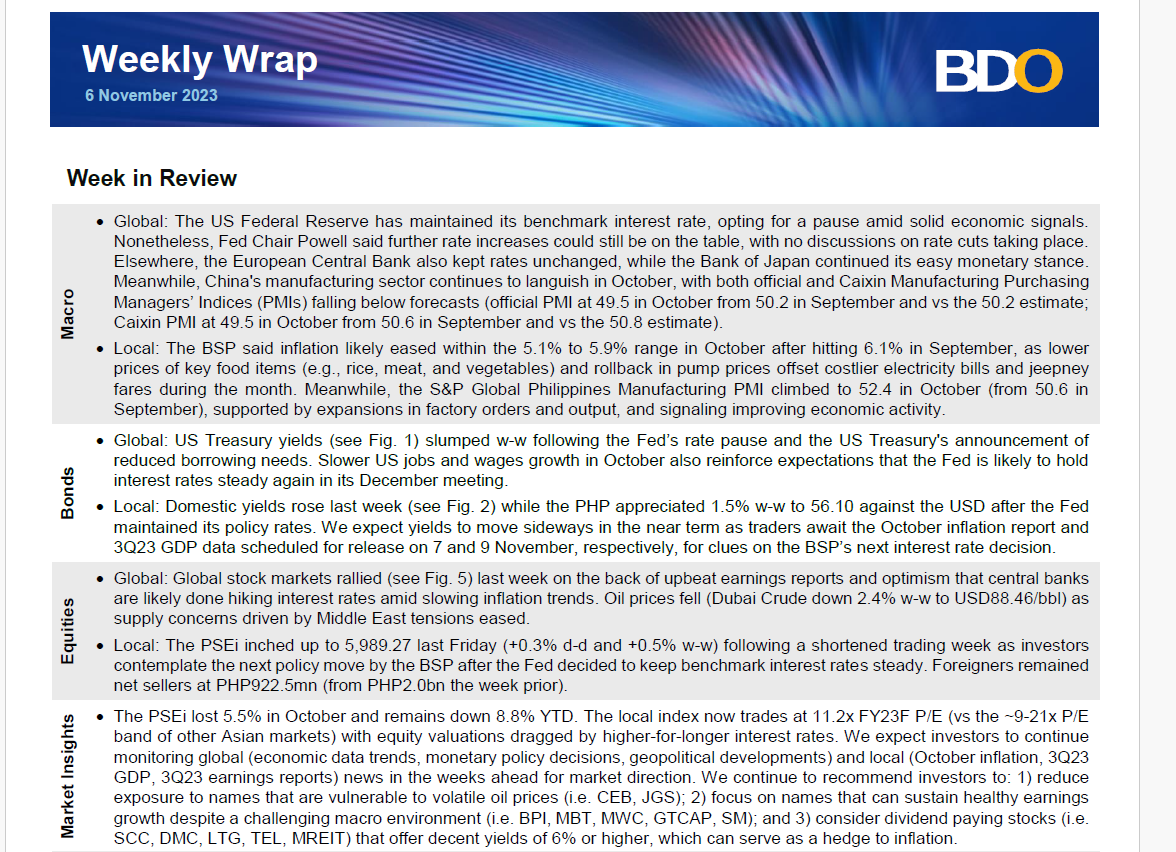

Finding dividend stocks is easy with BDO Securities. The Weekly Wrap report includes a list of dividend yields of forty plus stocks covered by BDO Securities. This report can help you find stocks that pay dividends (see below):