Whether you’re new to investing or you’ve been doing this for a while, chances are you’ve heard of dividends. These are payments (usually paid in cash) to shareholders of a company. The dividend discount model uses dividends to derive a target price for a stock.

Remember, target prices are calculated by BDO Securities analysts for the stocks we cover. We use the dividend discount model to value some stocks, such as Metrobank, BPI, and Security Bank. You can always find these target prices in the Weekly Wrap and/or coverage reports.

How to calculate for DDM

The formula for DDM is as follows:

Target price of stock = forecasted dividend / (cost of equity – growth rate of dividend)

Given the above formula, we can now discuss each of the variables in the DDM.

Forecasted dividend – If the company has a consistent history of dividend payments, you may be able to project next years’ dividend based on average dividend payout ratios and earnings growth. Such consistency can also be attributed to a company’s dividend policy (if in place). This is a formal program that the company normally adheres to (but still subject to the Board’s approval) and is the reason why a company pays out x% of previous year’s net income to shareholders as dividends. This percentage (%) is known as the Dividend Payout Ratio and differs from one company to another.

Cost of equity – There is more than one way to calculate the cost of equity. But one common method is to take a historical average market risk-free rate and add a market risk premium to this.

The market risk-free rate is normally associated with the long-term PH government bond. While the risk premium would be the estimated credit spread taking into account current market risks.

Growth rate of the dividend – one way to calculate the growth rate of the dividend is by multiplying the dividend payout ratio by the return on equity (ROE).

Hypothetical example of DDM

To better understand DDM, we can use the hypothetical company, AAA Corp. The information needed for DDM is as follows:

Forecasted dividend = P1.00

Cost of equity = 14%

Dividend payout ratio = 25%

ROE of the company = 13%.

Before we discuss the forecasted dividend, let’s talk about the dividend payout ratio.

We will assume that at the end of the fiscal year, AAA Corp. has the following earnings (profits) and pays the following dividend:

Earnings = P1 Billion

Dividend = P250 million

As we can see, AAA Corp. has a profit of P1 billion but only pays a dividend of P250 million. This is because corporations retain some earnings and reinvest them in the business. We can calculate the dividend payout ratio of AAA Corp. as follows:

Dividend Payout Ratio = dividend / earnings

Dividend Payout Ratio = P250 million / P1 billion

Dividend Payout Ratio = 25%

We can now look at the historical dividend payout ratios as follows:

2017 – 25%

2018 – 25%

2019 – 25%

Since the dividend payout ratios have remained consistent, we don’t have to factor in a change in the payout ratio when calculating the forecasted dividend.

We can now look at the historical dividend paid by AAA Corp. as follows:

2017 – P0.76

2018 – P0.83

2019 – P0.91

We can see from the above dividend payments that the growth of the dividend is consistently around 9-10%. Since the dividend payout ratio has remained constant and dividends have grown around 9-10% annually, we can assume the dividend will grow at a similar rate and we can forecast a dividend of P1.00.

Now, to calculate the growth rate of the dividend for AAA Corp. we can do the following:

Growth rate of dividend = (ROE * [1 – dividend payout ratio])

Growth rate of dividend = .13 * (1-.25)

Growth rate of dividend = .0975 = 9.75%

Now that we have the growth rate of the dividend, we can calculate the target price of AAA Corp. as follows:

Target price of stock = forecasted dividend / (cost of equity – growth rate of dividend)

Target price of stock = P1.00 / (0.14 – 0.0975)

Target price of stock = P23.53

We’ve used the DDM to calculate a P23.53 target price for our hypothetical stock, AAA Corp. The next step you would take is to look at the current stock price of AAA Corp. If the stock were trading for less than your P23.53 target price, it could be a potential buy for you.

DDM using BPI

To show a real-world example of the dividend discount model at work, we can use Bank of the Philippine Islands (BPI) as an example through our recent coverage report.

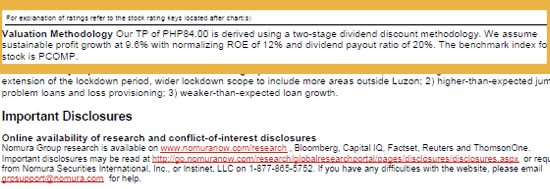

The analysts at BDO Securities use a slightly more complicated method to calculate the DDM for BPI than was shown in our example above. First, they assume annual dividends to be fixed for 3 forecast years, consistent with the historical fixed dividend payouts. They then project a terminal value based on an assumed average dividend payout ratio of 20%, cost of equity of 11%, sustainable normalizing ROE of 12%, and a growth rate of 9.6%.

If you’re not familiar with terminal value:

It’s a financial method used to calculate the value of all future cash flows past the forecasted date. In this example, it is used to calculate the value of all future dividends after the third year.

After the analysts’ calculations, a target price of P84.00 is computed for BPI. Since the current stock is trading at P59.50, there is an upside potential of +41.2%.

BPI Coverage Report

Below you can see the location of some of the information in the BDO Securities coverage report of BPI.

Dividends per share

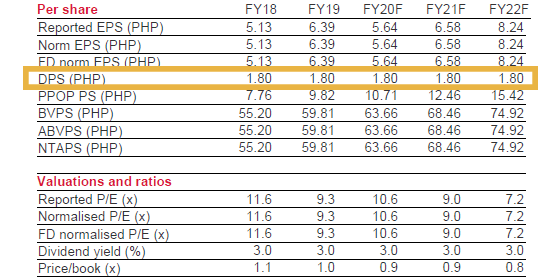

On page two of the BPI coverage report, you can see the dividends per share 2018 – 2022 (forecasted). Every coverage report includes per share information and dividends per share can be found here

Valuation methodology

Under the appendix section of page 5, you can see the valuation methodology. This can help shed light on the assumptions used by the BDO Securities analysts. The above snippet shows the assumption of a 9.6% growth rate, as well as normalized ROE of 12% and an assumed dividend payout ratio of 20%.

Issues with DDM

There is one important issue with DDM we should mention. As you may have realized, it’s impossible to use DDM to value a stock if the company does not consistently pay dividends. Many start-up stocks in their growth phase do not pay dividends, as they reinvest most of their profits back into the company to expand operations. As such, DDM is often used for more established or mature companies with a history of consistent earnings, cash flows, and dividend payments. DDM isn’t an appropriate tool to value companies that lack the track record of consistent earnings and dividends.

Read our suggested article below to help you invest with BDO Securities:

How to Find Dividend Paying Stocks with BDO Securities

Disclaimer: This is not a research report. The information, opinions and analysis contained herein are based on sources and data believed to be reliable but no representation, expressed or implied, is made as to its accuracy, completeness or correctness. This material is only for the general information of the authorized recipients. In no event shall BDO Securities or its officers and employees, including the author(s), be liable for any loss/damage resulting from reliance, directly or indirectly, or information found within this report.