The DCF method of valuation is like the dividend discount model in that it calculates a target price for a stock. However, unlike the dividend discount model which uses projected dividends by a company to calculate the target price, the DCF method uses company projected/future cashflows to calculate the target price.

Time value of money

To understand DCF, it’s important to first understand the time value of money.

Let’s use an example to start:

If you were offered the choice between accepting P100 today or P100 two years from now, what would you choose? More than likely, you would choose to take the money today. Let’s say your goal is not to spend the money, but to save it. Why then would you still want the money today and not two years from now?

Think about inflation. If prices for goods increase by 5% each year, your P100 will be worth less money in the future. By accepting the same P100 one year from now it will only be worth the equivalent of P95 (P100 less 5% inflation) in today’s pesos. Two years from today the P100 is only worth P90.25 (P95 less 5% inflation).

The time value of money is important to understand in terms of the DCF valuation.

Discounting cashflows

One way to think of DCF valuation is that it attempts to calculate the present value of a company using the future cashflows of the company. Let’s use an example to understand the present value of future cashflows.

Imagine a company has cashflows of P1,000,000 this year. If the company does NOT grow cashflows next year, how much will the cashflows be next year? Of course, they will still be P1,000,000.

The next question is, how much are next year’s cashflows worth today? Or, what is the present value of next year’s cashflows.

Like in our P100 example, if we assume 5% inflation, next year’s P1,000,000 cashflow will be worth P950,000.

So the present value of next year’s cashflow is P950,000.

In finance, the price of a stock is considered to be the present value of all future cashflows.

To understand how a stock price is considered the present value of all future cashflows, we can assume the same company above has P1,000,000 in cashflows over the next 5 years. Below is the value of those future cashflows.

Year 1 Cashflow: P1,000,000

Year 2 Cashflow: P1,000,000

Year 3 Cashflow: P1,000,000

Year 4 Cashflow: P1,000,000

Year 5 Cashflow: P1,000,000

Total cashflows: P5,000,000

The problem with the cashflows above is that they are not DISCOUNTED into today’s pesos. Let’s calculate the present value of these future cashflows if inflation is 5%.

Year 1 Cashflow: P1,000,000 x (1-5%) = P950,000

Year 2 Cashflow: P1,000,000 x (1-5%)^2) = P902,500

Year 3 Cashflow: P1,000,000 x (1-5%)^3) = P857,375

Year 4 Cashflow: P1,000,000 x (1-5%)^4) = P814,506

Year 5 Cashflow: P1,000,000 x (1-5%)^5) = P773,780

Total cashflows: P4,298,161

As you can see, the total cashflows over the next 5 years are not worth P5,000,000. Rather, they are worth P4,298,161.

Discount rate

We used a 5% inflation rate as a simplistic way to discount future cashflows. However, when valuing a company, the calculation of the discount rate is a little more complicated.

Many analysts use something called the weighted average cost of capital (WACC) as their discount rate. Since WACC may seem a bit complicated, we won’t be going over the formula here. But you can think of WACC as the average rate of return expected by stock and bond holders. Since equity investors and debtors of a company may expect different rates of returns, WACC attempts to derive an average cost of capital between both equity investors and debtors.

Now that we know about WACC, we can replace our above example assuming WACC is 9% (instead of 5%).

Year 1 Cashflow = P1,000,000 x (1-WACC)

Year 1 Cashflow = P1,000,000 x (1-9%)

Year 1 Cashflow = P910,000

We can now use WACC for the cashflows which equal the following:

Year 1 Cashflow: P1,000,000 x (1-9%) = P910,000

Year 2 Cashflow: P1,000,000 x (1-9%)^2 = P828,100

Year 3 Cashflow: P1,000,000 x (1-9%)^3 = P753,571

Year 4 Cashflow: P1,000,000 x (1-9%)^4 = P685,749

Year 5 Cashflow: P1,000,000 x (1-9%)^5 = P624,032

Total cashflows: P3,801,452

Growth

In many situations, a company will experience growth in cashflows. If cashflows have grown in the past and are expected to continue growing into the future, you will need to factor in that growth. Using our above example, if we looked back at the past 5 years of cashflows and saw an average growth of 5%, we may assume that rate going forward:

Year 1 Cashflow: (P1,000,000* (1+growth rate)) / (1-9%)

Above we add the growth in the cashflow then discount that using WACC.

We can determine the following cashflows:

Year 1 Cashflow: (P1,000,000 x (1 + 5%)) / (1-9%) = P963,303

Year 2 Cashflow: (P955,500 x (1+5%)^2) / (1+9%)^2 = P927,952

Year 3 Cashflow: (P912,980 x (1+5%)^3) / (1+9%)^3 = P893,899

Year 4 Cashflow: (P872,352 x (1+5%)^4) / (1+9%)^4 = P861,095

Year 5 Cashflow: (P833,532 x (1+5%)^5) / (1+9%)^5 = P829,495

Total cashflows: P4,475,745

After forecasting a 5% growth rate in our cashflows, we have calculated a total of P4,475,745 worth of discounted cashflows over the next 5 years.

Terminal value

Let’s go back to our idea that the price of a stock is considered to be the present value of all future cashflows. So far, in our above examples, we are only using 5 years of cashflows. In reality, since the stock price is the present value of ALL future cashflows, we need to calculate ALL future cashflows going forward.

We can do this using a terminal value. If you recall from last weeks’ dividend discount model, we used a terminal value and defined it as:

A financial method used to calculate the value of all future cash flows past the forecasted date.

In our example, we will use the terminal value to calculate the value of all cashflows after the fifth year. We can use the following formula to calculate the terminal value.

Terminal value:

Final year projected cash flow * (1+ perpetual growth rate) / (Discount rate – perpetual growth rate)

We can use the following assumptions for terminal value:

Final year projected cashflow = P829,495 (from our previous example).

Perpetual growth rate = 4%

Discount rate = 9% (WACC)

Perpetual growth rate = 4%

We can calculate terminal value as the following:

Terminal value: P829,495 * ((1+ 4%) / (9% - 4%))

Terminal value: P829,495 * 20.8

Terminal value: 17,253,505

Since we have the terminal value, we can simply add our 5 years of discounted cashflows to the terminal value:

DCF = 5 years discounted cashflows + terminal value

DCF = P4,475,745+ P17,253,505

DCF = P21,729,250

Interpreting the DCF

Again, let’s go back to those wise words, the price of a stock is considered to be the present value of all future cashflows.

As we have calculated, the present value of all future cashflows turns out to be P17,362,370. Let’s assume the stock has 15 million shares outstanding. This means that according to our DCF, the stock should be worth:

Target price of stock = value of company / shares outstanding

Target price of stock = P21,729,250 / 15,000,000

Target price of stock = P1.45 per share

Now that we know the stock should be trading at around P1.45 per share, we can look at the current trading price. If the price is only P1.30, there’s an upside of 11.5%. It’s then your decision whether this is a large enough upside for you. If it is, you may want to purchase the stock.

DCF and RRHI

Let’s take a look at a recent coverage report using DCF valuation. The Robinsons Retail Holdings (RRHI) coverage report was recently published by BDO Securities and we can see the target price below on the very first page of the report.

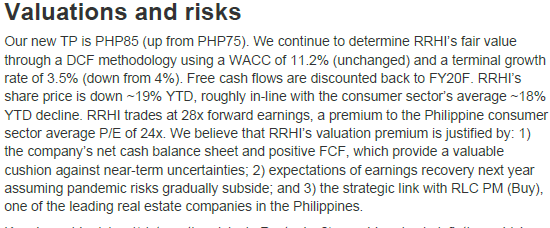

The PHP 85.00 target price forecasted by the BDO Securities analysts was derived through the use of a DCF valuation. Some additional information regarding the inputs used by the analysts can be found under the Valuations and risks section of the report.

As you can see, the WACC used was 11.2% and the terminal growth rate used was 3.5%.

After the DCF analysis, the BDO Securities analysts calculate the target price of RRHI as P85.00. Given the current price of RRHI is P65.00 there is an upside potential of just over 30% for RRHI.

Other article to help you invest and find stocks with BDO Securities

Dividend Investing with BDO Securities

Disclaimer: This is not a research report. The information, opinions and analysis contained herein are based on sources and data believed to be reliable but no representation, expressed or implied, is made as to its accuracy, completeness or correctness. This material is only for the general information of the authorized recipients. In no event shall BDO Securities or its officers and employees, including the author(s), be liable for any loss/damage resulting from reliance, directly or indirectly, or information found within this report.