Weekly Wrap

HOW TO READ A BDO SECURITIES WEEKLYWRAP TO FIND STOCK MARKET INVESTMENTS

Every week BDO Securities highly talented team of research analysts produce a weekly summary called the Weekly Wrap.

The summary is a perfect starting point for new investors to begin their search for stock market investments.

It’s also a powerful tool for practiced investors to keep up with the latest happenings, and to stay tuned to BDO Securities recommendations each week.

When it comes to finding the right stocks to buy, the Weekly Wrap can be a tool used by investors on their hunt for stock market investments.

Below, we will discuss how you can use the Weekly Wrap to find stock ideas, as well as how to read the Weekly Wrap.

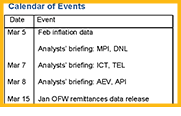

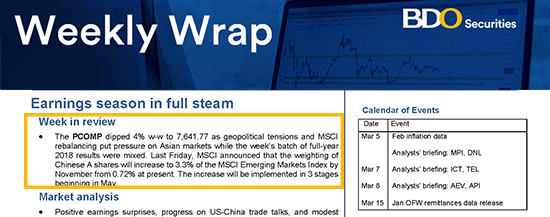

Above: The two-page Weekly Wrap from March 4, 2019

Using the Weekly Wrap to find stocks

Many investors have the same problem…

…they don’t know where to start when it comes to investing in the stock market.

Luckily, the Weekly Wrap can help.

There are two main parts of the Weekly Wrap to help with stock ideas.

The first section is the Stocks to Watch section.

The second section is the Stock Coverage Section.

The Stocks to Watch section

One of the most important sections of the Weekly Wrap is the Stocks to Watch section highlighted below.

With the Stocks to Watch section, there’s no need to spend hours reading reports and financial statements - you can simply read the Stocks to Watch section each week and listen to what the analysts have to say……let the analysts do all the hard work.

If the research team likes a particular stock or changes the rating on a stock to Buy, you may want to look into buying it.

Using the Stocks to Watch section as a novice investor

Are you new to investing?

Or…

…are you lacking knowledge when it comes to accounting and investment terminology?

A great part about the Weekly Wrap is you can use it even if you don’t understand all the terminology.

Take the above example:

As you can see, BDO Securities’s analysts believed the first stock mentioned, MWIDE, was undervalued - this means the research team thought the company was a good buy at the time the report was published.

All you need to understand is MWIDE remains undervalued, and that the research team reiterates its Buy rating.

The sentences highlighted in yellow boxes above tell you plenty of information regarding a stock being a good buy or not.

If you read the WEKLYWRAP each week, it may help you find great stocks to invest in – it may also help you avoid investing in some problematic companies.

The Stock Coverage section

Besides the Stocks to Watch section of the Weekly Wrap, the Stock Coverage section is an equally great way to find quality stock investment ideas.

The Stock Coverage section includes all stocks covered by BDO’s research analysts.

See the example below:

While there is a healthy amount of information in this table, the two most important columns include the Rating column and the Upside/Downside column.

For example, below are the numbers for Jollibee (JFC):

You may not understand ALL these numbers – but, at the very least you can understand the BDO Securities team believes Jollibee is a Buy.

Above you can see highlighted in the yellow box that Jollibee holds a Buy rating from BDO Securities.

Understanding that Jollibee is a Buy is easy.

Next, we should understand the Upside/Downside column.

As you can see below, the Upside for Jollibee is projected to be 21.4% by BDO Securities.

This is the percent gain BDO Securities believes is possible when buying Jollibee (it’s the difference between the current price of the stock and the target price).

For many, a potential 21.4% gain would be a very desirable return.

Of course…

There are stocks on the stock coverage report with lower upside potential, and there are stocks with higher upside potential.

It’s up to you how much upside potential you desire when buying stocks. This report can - at the very least - be a guide for you.

How to read the Weekly Wrap

The Weekly Wrap includes seven sections on the first page and one section on the second page:

The sections on the first page of the Weekly Wrap include:

- Week in review

- Market analysis

- Stocks to watch

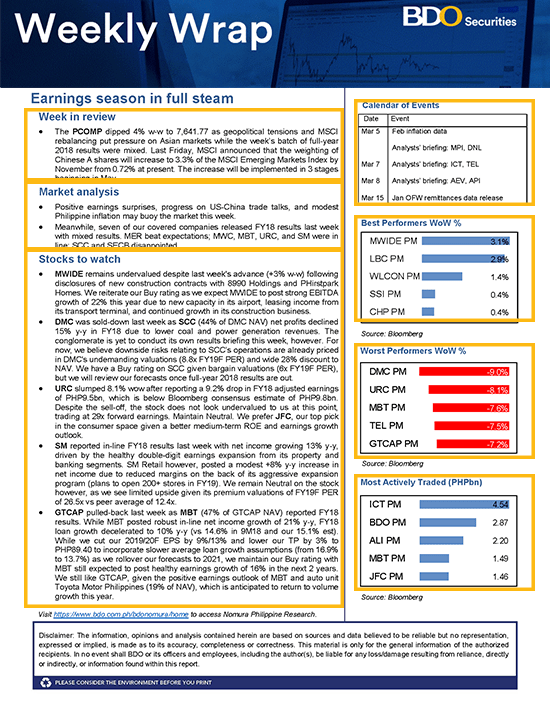

- Calendar of events

- Best Performers WoW % (week over week percentage)

- Worst Performers WoW % (week over week percentage)

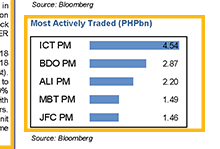

- Most actively traded (PHPbn)

The section on the last page of the Weekly Wrap includes:

- Stock Coverage

Week in review

The Week in review offers a summary of the market week. This section will include analysis about the overall broad Philippine Stock Market over the past week.

Market analysis

While the Week in review focuses on the prior week’s performance, the Market analysis section provides a perspective from BDO Securities regarding what to watch for during the upcoming week.

Stocks to watch

As was discussed earlier, the Stocks to watch section can be a great source of information for potential stocks to Buy, Sell, or Hold. Each week BDO Securities will highlight important stock features in this section.

Calendar of events

The calendar of events section provides the upcoming events for the week. Read this section to stay informed regarding important events during the upcoming week.

Best performers WoW %

The Best performers WoW % section shows the best performing stocks over the previous trading week. WoW % stands for week over week percentage. This is the percent gain from the start of the week until the end of the week.

Worst performers WoW %

The Worst performers WoW % section highlights the opposite of the Best performers WoW %. It shows the worst performing stocks over the previous trading week (WoW % - the percent loss from the start of the week until the end of the week).

Most Actively Traded (PHPbn)

The Most actively traded (PHPbn) shows the stocks with the highest volume trading for the week. These numbers are in billions of PHP. For example, the above stock, ICT PM traded PHP 4.54 billion in volume last week.

Coverage

As discussed earlier, the Stock Coverage table provides information for all companies analyzed by BDO Securities. This table is great for finding BDO Securities’s stock ratings (Buy, Sell, Neutral), and the Upside/Downside potential of the stocks.

The columns included in the Stock Coverage table include:

- Company Name

- Market Cap (USDmm) – The size of the company after adding the total of all traded shares (shown in millions of U.S. Dollars).

- Rating – Buy, Sell, Neutral, No Rating.

- Last Price – The last closing price of the stock.

- Target Price – The price BDO Securities believes the company should trade for.

- Upside/Downside – The difference between the current price and the target price.

- P/E (x) FY 19F – The forecast price to earnings for fiscal year 2019.

- P/E (x) FY 20F – The forecast price to earnings for fiscal year 2020.

- EPS Growth FY 19F – The forecast earnings per share growth of a company for fiscal year 2019.

- EPS Growth FY 20F – The forecast earnings per share growth of a company for fiscal year 2020.

- Div Yield – A percentage metric for dividends calculated by dividing the dividend payment by the price of the stock.

- P/B (x) FY 19F – The forecast price to book value of a stock for fiscal year 2019.

- ROE FY 19F – The forecast return on equity of the stock for 2019.

Conclusion – using the Weekly Wrap to your advantage

The Weekly Wrap – being just two pages long – is easy to digest and a great way to find stocks for beginners.

The report is also a nice tool for experienced investors to keep up to date with the market.

The Weekly Wrap isn’t the only tool an investor should use when searching for stocks to buy.

However…

It’s a great tool for the beginner just starting out, and it’s a nice way for experienced investors to keep up with the market on a weekly basis.

Use the WEELYWRAP to your advantage – it may just help you become a better investor.

BDO Securities customers who wish to receive these reports via email, please send us a message at bdosec-customercare@bdo.com.ph.

PSE and PDEx Trading Participant; SCCP and SIPF Member