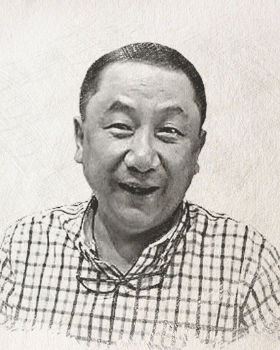

” We were once just a small construction supply business. Now, we have been in business for almost 40 years, and we are so lucky because we were able to expand to so many other businesses: hotels, resorts, and real estate. All of this is made possible because until now, BDO remains to be one of our biggest creditors.

BDO was there to always be of help during times of crisis—first when our business in Tagaytay was affected by the Taal eruption, and of course now, during the COVID-19 pandemic. It was sad that just when Enhanced Community Quarantine was announced, I got diagnosed with COVID-19. Thank God, I fully recovered quickly. When I recovered, I immediately started talking to BDO. I asked them how they could help support and jumpstart my businesses again because everything had to close due to the lockdown and business was down.

Trying to get back on my feet, my problem was how to gain revenue and return to my obligations. Thanks to BDO, they helped me learn how to extend credit. I’m so happy because with the bank’s support, I was able to update my business financials. Before, businesses focused mainly on revenue—now, the main goal of business like ours is to survive, stay healthy, and support our people. All of these were made possible by the advice and support given to us by BDO through the years.

The most important thing to remember when choosing a good creditor is to not be greedy. Do not over borrow. Since businesses use loans for expansion, they should know when to expand and when to not expand. It is also important to pay on time. These steps help establish trust with your bank, especially like BDO.”