THE PERSONAL EQUITY AND RETIREMENT ACCOUNT (PERA)

Republic Act No. 9505, otherwise known as "The Personal Equity and Retirement Account (PERA) Act of 2008*, was signed into law on August 22, 2008.

PERA provides Filipinos a tax exempt facility to supplement their future pension benefits from SSS/GSIS and from their own employers. The law also provides employers an opportunity to become agents in furthering the objectives of the State to promote savings mobilization and capital market development.

PERA can help you gift yourself with a more comfortable retirement.

What is PERA?

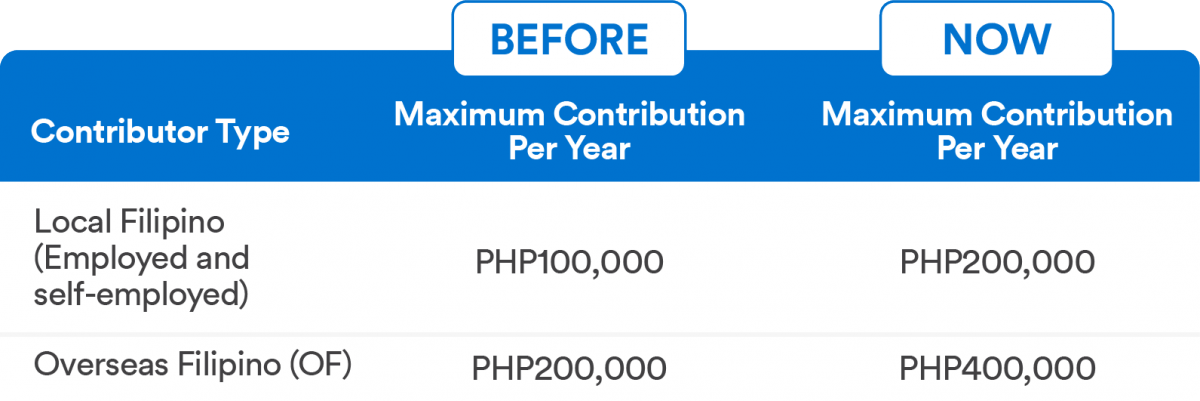

Good news effective 2023! PERA has doubled the maximum allowable annual contribution allowing you to invest more for your future.

BDO takes pride in being the first accredited PERA Administrator in the country.

To know more about PERA, we have prepared the following answers to frequently asked questions (FAQs).