SME Loan

- Overview

- Interest Rate

- Application Requirements

- FAQs

- Loan Calculator

- Videos & Articles

- Useful Links

- Loan Client Request

WHAT WE OFFER

Term Loan

Term Loan provides funding for long-term business investments.

Check our SME Loan Calculator and get a quick computation to help you with your loan decision.

Click here to inquire about BDO SME Loan.

SME Ready Check

SME Ready Check is a revolving credit line which gives access to funds whenever your business needs it.

Check our SME Loan Calculator and get a quick computation to help you with your loan decision.

Click here to inquire about BDO SME Loan.

Know More

Check our SME Loan Calculator and get a quick computation to help you with your loan decision.

Click here to inquire about BDO SME Loan.

HOW TO APPLY

Step 1: Check your Qualifications

Step 2: Prepare the Documents

Step 3: Submit Application Form and Requirements

TOOLS TO HELP YOU

Links

Commercial Properties for Sale

New SME Loan Applications

|

Fixing Period

|

Interest Rate |

| 1 year | 7.00% |

Note: Quoted rate is subject to change without prior notice.

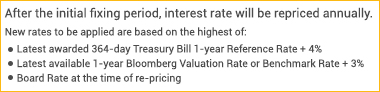

Existing SME Loan Borrowers

to get an estimate of how much you can borrow.

Step 1: Check your Qualifications

Step 2: Prepare the Documents

Step 3: Submit Application Form and Requirements

APPLYING FOR AN SME LOAN

1. How much can I borrow?

You can borrow up to 70% of the value of your real estate properties.

For instance, you can loan up to 5.6M for a House & Lot with an appraised value of 8M.

Appraised value maybe determined during property appraisal, upon loan application.

2. What are the loan related fees that I need to prepare for?

| Pre-approval Fees* | ||

|

Appraisal Fee (per title) |

P5,000 if collateral is within 30 km. radius from any BDO branch. P5,500 |

|

| Post-approval Fees* | |

| Handling Fee | P 5,000 |

| Notarization Fee | P 600 |

| Collateral Registration Fee | Based on the approved loan amount and standard Registration of Deeds (RD) fees. |

| Documentary Stamp Tax | P1.50 for every P200 of the approved loan amount |

| Credit Life Insurance | P4.75 for every P1,000 of the loan amount (assuming standard rate for borrowers up to 49 years old) |

| P6.50 for every P1,000 of the loan amount (assuming standard rate for borrowers ages 50 to 69 years old) | |

| Fire Insurance (FI) Premium | Based on the appraised value of the improvement on the property submitted as collateral. |

| Contractors All Risk Insurance (CARI) | Based on the estimated bill of materials of the property for construction. |

|

Processing Fee (for SME Ready Check) |

Based on percentage of approved credit line |

*Subject to change without prior notice.

You can pay the loan-related fees at any BDO branch.

3. How long will it take to approve my SME Loan?

If you have submitted your application form along with your identification, income and property or collateral documents, you will receive a loan decision within 10 banking days.

MAINTAINING MY SME LOAN

1. What are the modes of payment for my SME Loan?

For Term Loan

• Monthly loan payments are deducted from your enrolled BDO account via Automatic Debit Arrangement (ADA)

You may refer to your Amortization Schedule for your monthly payment and loan details.

For SME Ready Check

• Minimum amount due is deducted from your enrolled BDO account via ADA.

• Outstanding Balance maybe paid in partial or in full over the counter at any BDO branch nationwide.

You need to settle at least 5% of your availed amount every quarter.

This will be added to your minimum amount due.

For easy monitoring of your transactions, you can check your monthly electronic Statement of Account (eSOA) which indicates your available credit line, minimum amount due, total outstanding balance and other credit line details.

Note: Please ensure that your account is sufficiently funded before the due date of your monthly loan payments to avoid penalties and late payment charges.

2. Is it necessary to get insurance in relation to my loan?

Yes. Getting insurance is important for your own security and to protect your property from unfortunate incidents that may happen during the term of your loan.

Credit Life Insurance (CLI) – Financial protection in case of untimely death or total disablement. It can pay off your loan’s total outstanding balance.

Fire Insurance (FI) – Financial protection for the property. It can pay off the damages or loss due to fire, calamity, catastrophe, etc.

Contractors All Risk Insurance (CARI) – Applicable to Construction Loan, it provides coverage for damage / risks normally associated with the construction project.

For Term Loan clients, BDO offers payment of insurance premium under the BUILT-IN INSURANCE facility.

Under this, premium is spread out in 12 monthly installments without interest and billed together with your monthly amortization.

For SME Ready Check, premium payment may either be deducted from an enrolled BDO Account via Automatic Debit Arrangement (ADA) or paid Over The Counter (OTC) at any BDO Branch nationwide.

ONLINE BANKING FOR BDO SME LOAN

1. How do I access my account online?

BDO Online Banking

To access BDO’s Online Banking, you should have a BDO Deposit Account or Credit Card.

If you are not yet signed up for BDO Online Banking, click here.

To set-up your SME Loan Account:

- Log in to your BDO Online Banking.

- Go to Enrollment Services.

- Add your SME Loan Account.

Once your account is set-up, you may view your Account and Transaction Details, such as Account Number, Interest Rate, Monthly Amortization, Outstanding Balance, etc.

BDO Loans Quick Inquiry

- Click here to check your account.

- Fill out the form with your loan account and personal details.

- You will receive a One-Time Password (OTP) through your registered mobile number to complete your log in.

Note: Online Banking and BDO Loans Quick Inquiry is only applicable for Term Loan.

2. How can I get a copy of documents in relation to my SME Loan

Please ensure to keep your contact information updated.

-

Click here to update your contact details.

-

On Update Client Information tab, choose whether you’re an Individual or Corporation.

-

Complete your loan details and click Submit.

To request for a copy of your loan documents, amortization schedule or full payment computation.

-

Click here to request for documents

-

On Document Request tab, check needed document and click Request Online.

-

Complete your loan details and click submit.

FEATURED VIDEOS

Planning for your business' next move?

Check out these videos to learn how BDO SME Loan

can take your business to the next level.

SME LOAN ENTREP TALKS

The Good Debt Series

Get insights and learn business strategies that will help you make informed decisions for your business

Commercial Properties For Sale

BDO SME Loan can help you obtain that much needed commercial space for your business. To get you started, click on the link below to go to the Real Estate web page.

Once there, just click on the dropdown button in the Type Field and choose “Commercial”. You will see a list of available commercial properties for sale. You also have the option to indicate your preferred area and price range.

List of Commercial Properties for Sale

To know more about a commercial property you’re interested in, you may get in touch with the BDO Asset Management Group at (02) 8702-7088 / (02) 8702-6000.

If you wish to apply for a BDO SME Loan to purchase a commercial property, please call (02) 8667-1624 / (02) 8631-8000 or 1-800-10-631-8000 (Domestic Toll-Free) or click here for the online application form.