About BDO

Corporate Profile

Awards and Citations

Core Values

Corporate Mission

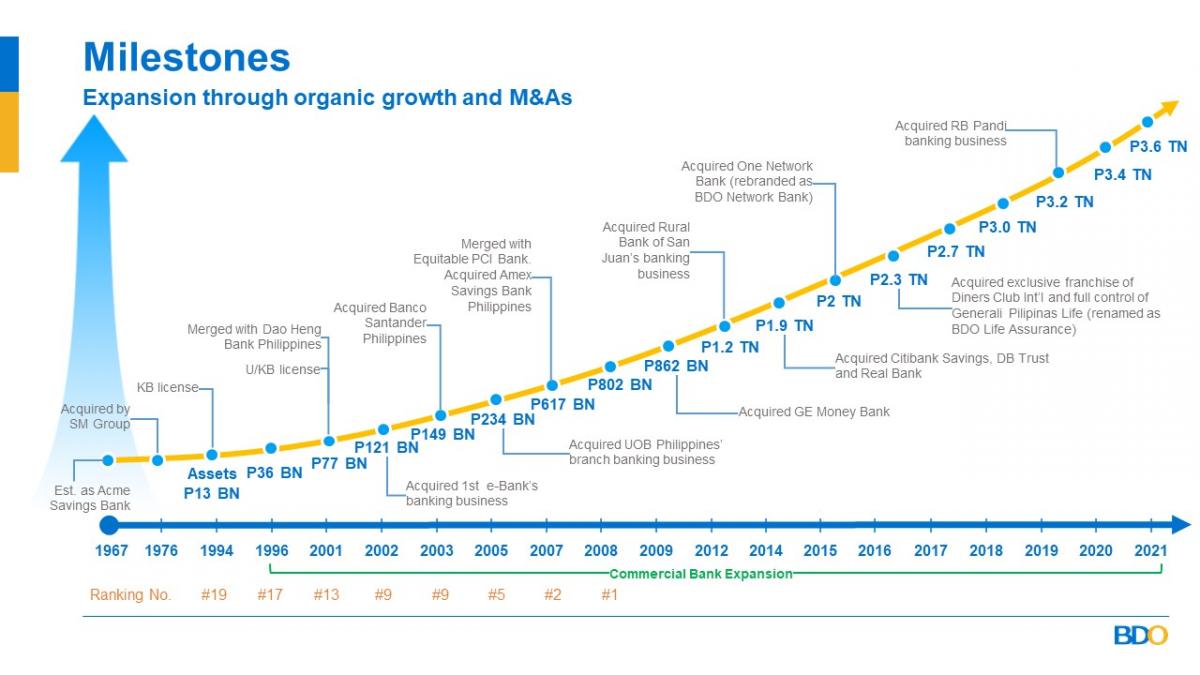

Milestones

Market Reach

Domestic and International Network

Correspondent Banks

CORPORATE PROFILE

BDO is a full-service universal bank in the Philippines. It provides a complete array of industry-leading products and services including Lending (corporate and consumer), Deposit-taking, Foreign Exchange, Brokering, Trust and Investments, Credit Cards, Retail Cash Cards, Corporate Cash Management and Remittances in the Philippines. Through its local subsidiaries, the Bank offers Investment Banking, Private Banking, Leasing and Finance, Rural Banking, Life Insurance, Insurance Brokerage and Online and Non-Online Brokerage services.

BDO’s institutional strengths and value-added products and services hold the key to its successful business relationships with customers. On the front line, its branches remain at the forefront of setting high standards as a sales and service-oriented, customer-focused force. The Bank has the largest distribution network with over 1,500 operating branches and offices, and more than 4,500 ATMs nationwide. BDO has 16 international offices (including full-service branches in Hong Kong and Singapore) spread across Asia, Europe, North America, and the Middle East.

The Bank also offers digital banking solutions to make banking easier, faster, and more secure for its clients.

Through selective acquisitions and organic growth, BDO has positioned itself for increased balance sheet strength and continuing expansion into new markets. As of 31 March 2022, BDO is the country’s largest bank in terms of consolidated resources, customer loans, deposits, assets under management and capital, as well as branch and ATM network nationwide.

BDO is a member of the SM Group, one of the country’s largest and most successful conglomerates with businesses spanning retail, mall operations, property development (residential, commercial, resorts/hotel), and financial services. Although part of a conglomerate, BDO’s day-to-day operations are handled by a team of professional managers and bank officers. Further, BDO has one of the industry’s strongest Board of Directors composed of professionals with extensive experience in various fields that include banking and finance, accounting, law, and business.

Awards and Citations

BDO is a recipient of multiple awards from various local and international award-giving bodies for both institutional and product excellence. A listing of these awards is detailed on the Bank’s website under “About BDO - Awards and Citations”.

Sustainability

BDO’s commitment to sustainability is fostered at the Board level. The Bank anchors its sustainable development strategy to the United Nations Sustainable Development Goals (SDGs). The sustainability strategies cover products, sustainability contribution, human capital, disaster response, and governance, in accordance with the Bank’s sustainability philosophy: “We seek to achieve resilience by incorporating sustainability in the way we do business. We aim to embed sustainability principles when making decisions, assessing relationships and creating products.”

The Bank released its fourth Sustainability Report outlining its economic, environmental, social, and governance performance as of December 2021. The Report is a substantiation of BDO Group’s commitment to the United Nations Social Development Goals (SDGs), the principles of the United Nations Global Compact, and the Greenhouse Gas (GHG) Protocol, and prepared in accordance with the GRI Standards: Core Option. Further, the Report has completed the GRI Materiality Disclosures Service, which confirms that the GRI Content Index is clearly represented and references for Disclosures align with appropriate sections in the report.

For more details on the Bank’s Sustainability initiatives, please refer to section on “Sustainability” under “Corporate Governance” of the Bank’s website. The Report can be accessed through this link.

CORE VALUES

Commitment to Customers

We are committed to deliver products and services that surpass customer expectations in value and every aspect of customer services, while remaining to be prudent and trustworthy stewards of their wealth.

Commitment to a Dynamic and Efficient Organization

We are committed to creating an organization that is flexible, responds, to change and encourages innovation and creativity. We are committed to the process of continuous improvement in everything we do.

Commitment to Employees

We are committed to our employees’ growth and development and we will nurture them in an environment where excellence, integrity, teamwork, professionalism and performance are valued above all else.

Commitment to Shareholders

We are committed to provide our shareholders with superior returns over the long term.

CORPORATE MISSION

To be the preferred bank in every market we serve by consistently providing innovative products and flawless delivery of services, proactively reinventing ourselves to meet market demands, creating shareholders value through superior returns, cultivating in our people a sense of pride and ownership, and striving to be always better than what we are today… tomorrow.

#BancoDeOro

#BDOBancoDeOro

#BDOUnibank

#BDORemit

#BDOWefindways

DOMESTIC AND INTERNATIONAL NETWORK

Click here for the complete list of international offices and partners: Directory of #BDORemit offices, partners and agents (pdf)

CORRESPONDENT BANKS

| Currency | Bank | Swift/BIC |

|---|---|---|

| AUD | Australia and New Zealand Banking Group Limited, Melbourne | ANZB AU 3M |

| CHF | Citibank NA, London | CITI GB 2L |

| EUR | Deutsche Bank AG, Frankfurt am Main | DEUT DE FF |

| EUR | Standard Chartered Bank (Germany) GmbH, Frankfurt am Main | SCBL DE FX |

| GBP | Barclays Bank PLC, London | BARC GB 22 |

| GBP | HSBC Bank plc, London | MIDL GB 22 |

| HKD | Banco de Oro Unibank Inc, Central | BNOR HK HH |

| JPY | Standard Chartered Bank, Tokyo | SCBL JP JT |

| JPY | Wells Fargo Bank NA, Tokyo | PNBP JP JX |

| SGD | Oversea-Chinese Banking Corp Ltd, Singapore | OCBC SG SG |

| USD | Bank of America NA, San Francisco | BOFA US 6S |

| USD | Citibank NA, New York | CITI US 33 |

| USD | Deutsche Bank Trust Company Americas, New York | BKTR US 33 |

| USD | JPMorgan Chase Bank National Association, New York | CHAS US 33 |

| USD | Standard Chartered Bank, New York | SCBL US 33 |

| USD | The Bank of New York Mellon, New York | IRVT US 3N |

| USD | Wells Fargo Bank NA, New York |

PNBP US 3N NYC |

Member: PDIC, Maximum Deposit Insurance for Each Depositor P500,000

Financial Statement Highlights

Capital and Funding History Highlights

| Year | Amount | Transaction/Issue | Offering Circular | Capital and Funding History Details |

| 2022 | Php 52.7 Bn | 2 Year ASEAN Sustainability Bond | View | View |

| 2020 | Php 40.1 Bn |

2 1/2 Year Senior Fixed Rate Bond |

View | View |

| Php 36.0 Bn | 1 3/4 Year Fixed Rate Bond | View | View | |

| USD 600 Mn | 5 1/2 Year Senior Notes | View | View | |

| 2019 | Php 35.0 Bn | 1 1/2 Year Senior Fixed Rate Bond | View | View |

| Php 7.3 Bn | 5 1/2 Year LTNCD Offer | View | View | |

| Php 6.5 Bn | 5 1/2 Year LTNCD Offer | View | View | |

| 2018 | Php 8.2 Bn | 5 1/2 Year LTNCD Offer | View | View |

| USD 150.0 Mn | Green Bond (private placement by IFC) | View | View | |

| 2017 | Php 60.0 Bn | 1:5.095 Stock Rights Offer | View | View |

| Php 11.8 Bn | 5 1/2 Year LTNCD Offer | View | View | |

| USD 700.0 Mn | 5 1/2 Year Senior Notes | View | View |

Articles of Incorporation and By-Laws

BDO Amended Articles of Incorporation SEC Approval

Links

Wolfsberg Anti Money Laundering Questionnaire

U.S. Patriot Act Certification

| BDO's FATCA Details | |||

|---|---|---|---|

| FATCA Status | Registered-Deemed Compliant Financial Institution/Reporting Financial Institution under a Model 1 Intergovernmental Agreement (IGA) | ||

| Date of Registration |

Date of Registrations: - as Participating FFI - 25 April 2014 - as Registered-Deemed - 27 March 2015 Compliant FI/Reporting FI under a Model 1 IGA |

||

|

GIIN (Global Intermediary Identification Number) |

URS0GI.00000.LE.608 | ||

| Contact Details of FATCA Responsible Officer | |||

| Name of Officer | Atty. Federico P. Tancongco | ||

| Job Title/Department | Chief Compliance Officer/Compliance | ||

| Telephone No. | +6328784202 | ||

| Email Address | |||

| FATCA Related Forms |

| Download W-8BEN-E |

|

Signed FATCA Questionnaire |

Member: PDIC, Maximum Deposit Insurance for Each Depositor P500,000