BDO ramps up digitization efforts with BDO Pay

2021 September – BDO Unibank has broadened its roster of digital banking channels with the introduction of a digital payment app that links directly to the client’s BDO account and credit card—making banking even more convenient, safer and responsive to its clients’ needs.

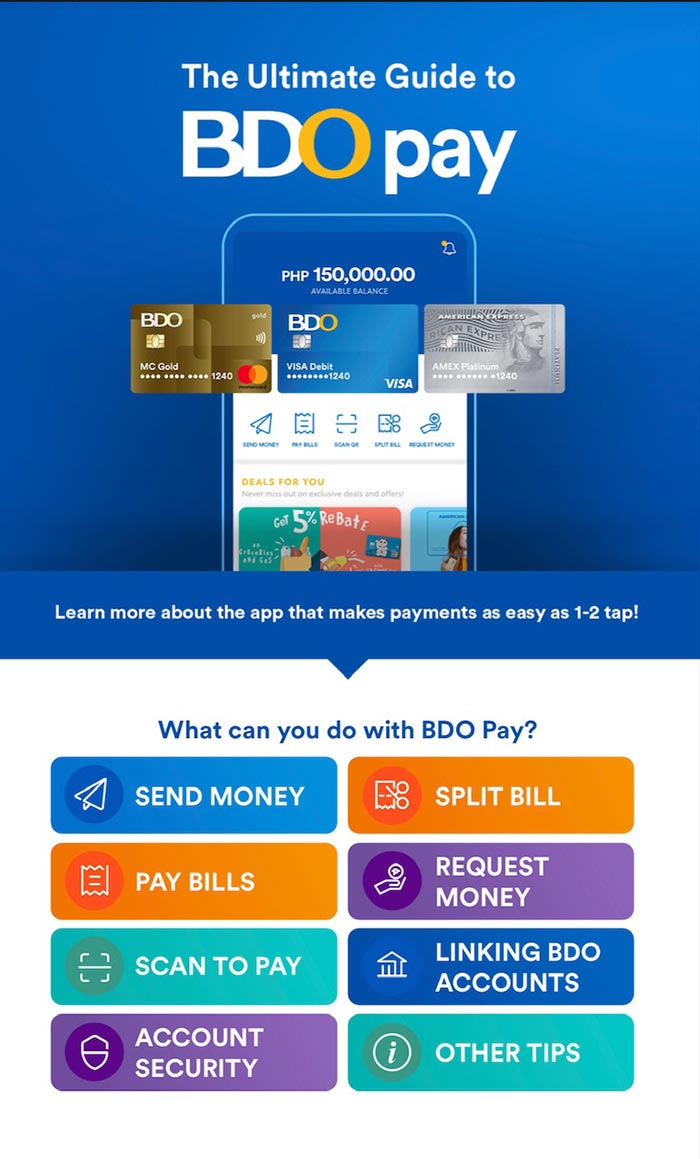

Called BDO Pay, this app will enable clients to use their savings account or credit card to do contactless payments for bills, to online sellers and various stores nationwide.

With this newest initiative, BDO clients need not move in and out of different apps just to transfer money from one account to another. Moreover, having a mobile payment app linked directly to a client’s bank account allows the former to save from paying cash-in fees repeatedly.

BDO clients with existing online banking account can easily use BDO Pay by just downloading the mobile app from Google Play, App Store, or Huawei AppGallery. For existing clients with no online banking account, they are encouraged to sign-up first via online.bdo.com.ph and enroll. Once the online banking account is activated, clients can already download the BDO Pay app and start using it.

Meanwhile, non-BDO clients are invited to open a BDO account to experience the features of the said mobile payment app.

Digital upgrades to better customer journey

BDO, which currently operates the most number of branches and ATMs in the country, has been enhancing its technology and security infrastructure to deliver its products and services in a faster, simpler, and more secure way for the clients.

“The digital initiatives do not only revolve around technology infrastructure, but also the revamp of operational processes and the engagement of experts to enable the Bank to be more agile and responsive to its clients’ needs,” said BDO.

During the height of the pandemic, the Bank saw a substantial increase in usage of its BDO Online Banking and Mobile Banking channels as they provide BDO clients instant and easy access to all their BDO accounts, namely, credit cards, deposits, loans, and investments.

The widespread adoption of the mobile and online banking habit is rising rapidly around the world largely due COVID-19. This has propelled the banks to embrace the advantages of digital banking and give their clients the ability and control to do bank transactions and payments without the need to visit a branch.

In the Philippines, Filipinos are becoming more and more comfortable with cashless payments and doing online banking transactions in the new normal. The Bangko Sentral ng Pilipinas (BSP) targets to bring 70% of adult Filipinos into the banked population by 2023, and hopes that 50% of transactions—in terms of volume and value—done digitally.

Related Stories: